How to choose the right vehicle for you

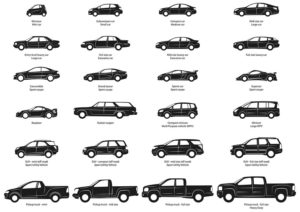

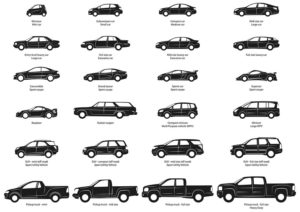

BUYING a car is a huge decision. Next to a home, it’s probably the second most important purchase anyone can make. But with the influx of new car models and…

Covering the week’s most noteworthy business news impacting the Filipino-American and Global Filipino community.

BUYING a car is a huge decision. Next to a home, it’s probably the second most important purchase anyone can make. But with the influx of new car models and…

Tips and hacks on how to negotiate when buying a car ACQUIRING an automobile to take you places can be a necessity, luxury or privilege. It could even be all…

THE new tax law could have an impact on how much your employer should withhold from your paycheck. Too little withholding from your paycheck could mean large unexpected tax bill…

A Filipina-American nurse from Dallas, Texas was sentenced last week for orchestrating a Ponzi scheme that cost victims — many of whom were also Filipino nurses — over $1 million….

YES, it can be. Going to a tax preparer who increases your refunds with phantom deductions is dangerous. You may have to return that nice refund … and more, sometimes…

Q:I HAVE been working for 5 years in a Los Angeles company with 52 employees. I requested a leave of absence from work to care for my sick 21 year-old…

“If you own a home and have assets that may be at risk if you were sued by your creditors, it is in your best interest to find out how…

WHAT is the means test in bankruptcy? It’s a method for calculating what your household income is for the purpose of determining if you qualify for Chapter 7 or Chapter…

During his speech in front of the Filipino community in Jordan last Friday, September 7, President Rodrigo Duterte blamed U.S. President Donald Trump as the cause of the current inflation…

IN February 2018, the IRS started certification of individuals with delinquent tax debt to the State Department. How will the IRS certification impact you? • Upon receipt of certification. The…

Gov. Brown signs new bill that aims to combat damaging effects of climate change Governor Jerry Brown signed two measures on Monday, Sept. 10 aiming to convert California to 100…

YES, shrinking budget reduces your chance of getting grilled by the IRS. • The main reason for the decline: IRS budget and staff levels are down. • Tax collectors are…

THE client is 50 and got divorced 10 years ago. Her ex-husband decided that working was not good for him so he just disappeared. They had one daughter that client…

(Your rights to reimbursements may be significant) Q: AS part of my work, I travel to clients using my own car and I pay for gas. I also make several…

ARE you sick and tired of being in debt and having bad credit? Do you want to start over but simply don’t know where to begin? Is filing bankruptcy an…

LA Found is a new initiative aimed to quickly locate individuals with cognitive impairments who wander and go missing Los Angeles County officials and health organizations on Wednesday, Sept. 5…

Real estate tycoon and former politician Manuel “Manny” Villar is now the Philippines’ second richest man after his wealth tripled due to the boom in the construction business that benefited…

Philippine President Rodrigo Duterte on Thursday, September 6 announce the creation of a department that would ease up the business process in the country for foreign investors. In his speech…

Warning letters for products that looked like juice boxes, cookies and candy part of efforts to protect youth from dangers of nicotine and tobacco product The U.S. Food and Drug Administration…

The governments of the Philippines and the State of Israel have signed three agreements that would strengthen the bilateral ties between the two countries. President Rodrigo Roa Duterte and Prime…

MARKETING veteran Arnold T. Gonzales was chosen unanimously by the Board of Directors, chaired by Tourism Secretary Bernadette Romulo Puyat, as Officer-in-Charge (OIC) of the Tourism Promotions Board (TPB), following…

JOIN us at Pechanga Resort Casino this September to celebrate the Mid-Autumn Festival with our exciting “Harvest Moon Grand Drawing”. There will be 50 winners of EasyPlay and one lucky…

ALEXANDER Brown and Arik Silva worked as retail sales associates at Abercrombie & Fitch Co., a company that operates retail clothing stores throughout the United States. Brown and Silva sued…

IF you are delinquent on your debts, you may be able to avoid dealing with the bill collectors for a few months but sooner or later, you will still need…

NO, merely renting out your house, condo, or apartment does not attract IRS audits. But yes, there are rental items that attract IRS scrutiny: • Deducting expenses that are disproportionately…

FOR those who are eyeing to buy a Maserati or Alfa Romeo in Southern California, look no further than Maserati Alfa Romeo of Puente Hills. Maserati Alfa Romeo of Puente…

1. BLENDED Federal Income Tax Rate: For Corporations tax elected to use a fiscal year will pay a blended tax rate and not the 21% flat rate. The new rate…

More than 200 buyers and over 220 sellers are set to participate in this year’s Philippine Travel Exchange (PHITEX) – organized by the Tourism Promotions Board (TPB), the marketing arm…

BEING audited by the IRS is dreaded by most taxpayers. My clients constantly asked which method increase their chances of getting audited. Let’s compare two methods of filing your tax…

THE clients are seniors who just stopped working two months ago. The husband is 75 and the wife is 71. They own a house with $140,000 in equity. Their unmarried…