BECAUSE of the current economic downturn, some people are interested about bankruptcy as a relief to their financial dilemma. I deem it therefore appropriate to discuss bankruptcy and Chapter 7 bankruptcy in particular.

Any person who resides or is domiciled in the US can file bankruptcy. In fact, a foreigner who owns property or has a business in the US can also file bankruptcy. Partnerships, corporations and limited liability companies are also eligible to file bankruptcy. Generally, spouses file a joint bankruptcy petition but one spouse can file a bankruptcy petition alone should he deem it fit.

Chapter 7 or the liquidation bankruptcy is the most common bankruptcy filing. Most debtors can discharge all or most of their debts under a Chapter 7 liquidation bankruptcy. Certain debts, however, are not discharged by bankruptcy. These includes, among others, debts from fraud or those arising from the debtor’s willful and malicious acts, spousal and child support, certain student loans and certain taxes and penalties,

A “means test” is used to determine if a debtor is eligible to file Chapter 7 bankruptcy. If the debtor’s monthly income is less than California’s family median income for his family size, he can file a Chapter 7 bankruptcy. If his monthly income is more, he has to pass the means test. Otherwise, he will have to file Chapter 13.

Under a Chapter 7 liquidation bankruptcy, the debtor’s properties may be sold by the trustee to pay off their debts unless they are exempt properties. [Exempt properties are those owned by the debtor that are exempt from execution of the judgment creditors.] However, most Chapter 7 filings are considered “no asset” cases, which means that the debtor does not have non-exempt properties that trustee can sell.

In California, debtors can choose either one of two (2) systems of exemptions, whichever is most advantageous for them. Included in the “703-series exemptions” system are a $25,575 exemption in equity in real or personal property if used by the debtor or dependent of the debtor as a resident, an exemption equal to $1350 plus and unused portion of the $25,575 exemption (called the “wild card” because it applies to any kind of property) and a $5,100 motor vehicle equity exemption for one motor vehicle. On the other hand, a notable exemption under the “704-Series exemption” system is the homestead exemption of $75,000 for a single person and is not disabled, $100,000 for families and no other member has a homestead, $175,000 if 65 years or older or physically or mentally disabled, among others. Note that these exemptions are applicable only to individual filers, not partnerships, corporations and limited liability companies.

A debtor is also required to undergo credit counseling from an accredited credit counseling agency in order to file a Chapter 7 bankruptcy. After the petition is filed, the debtor is required to attend the meeting of creditors (called the “341 meeting”) wherein a bankruptcy trustee conducts the meeting.

If you are contemplating of filing bankruptcy or other alternatives, it is advisable to seek the counsel of a bankruptcy lawyer to guide you on the intricacies of filing for such a petition.

* * *

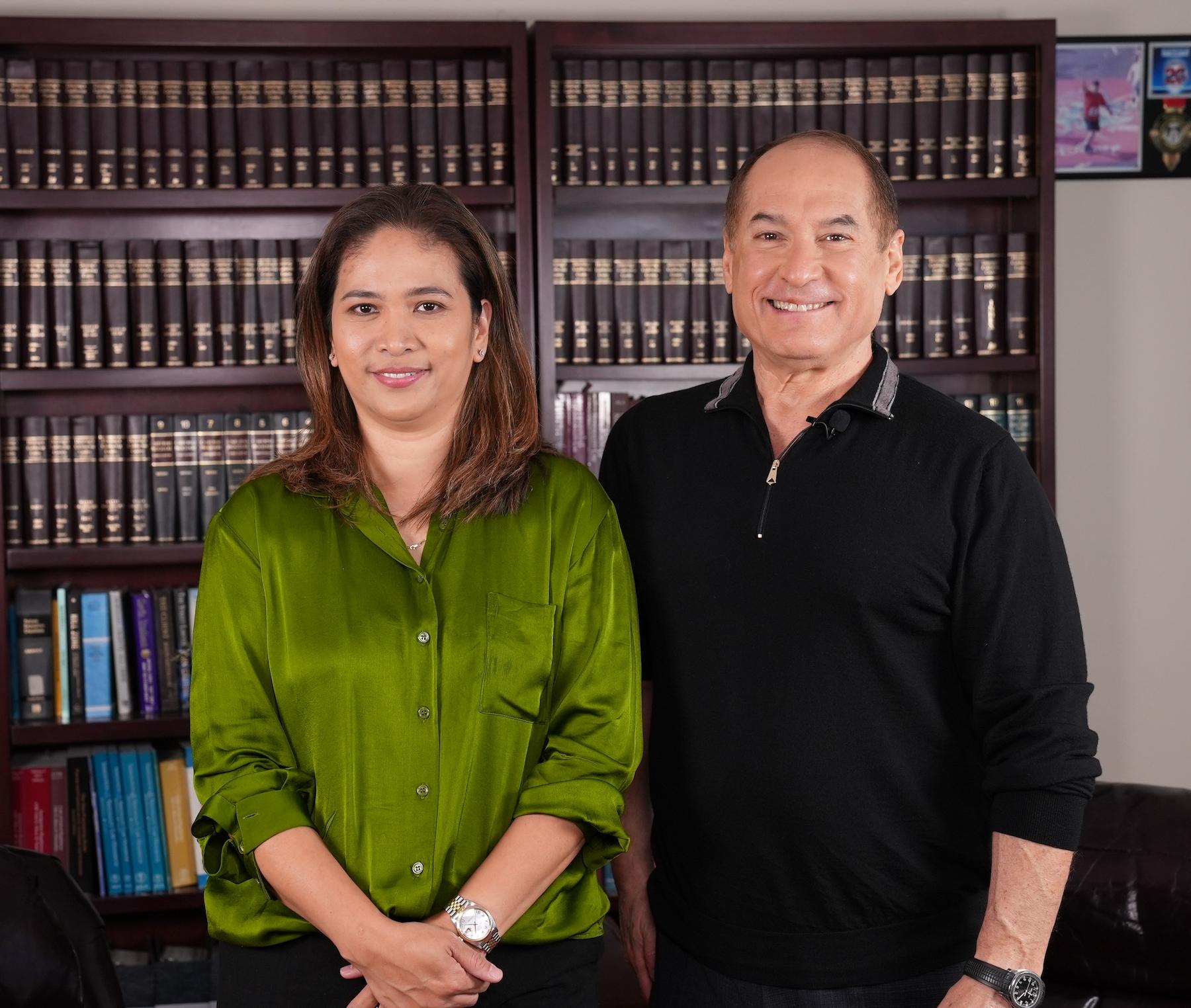

Atty. Gwendolyn Malaya-Santos is a member of the State Bar of California and the Integrated Bar of the Philippines. To schedule for a free initial in-person consultation, please call Tel. Nos. (213) 284-5984 or (626) 329-8215. Atty. Santos’ office is located at 3450 Wilshire Blvd., Suite 1200-105, Los Angeles, CA 90010.

* * *

Information contained in this article does not, nor is it intended to, constitutes legal advice for any specific situation and does not create a lawyer-client relationship. It likewise does not constitute a guarantee, warranty, or prediction regarding the outcome of your legal matter.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.