Does rental property attract IRS audit?

NO, merely renting out your house, condo, or apartment does not attract IRS audits. But yes, there are rental items that attract IRS scrutiny: • Deducting expenses that are disproportionately…

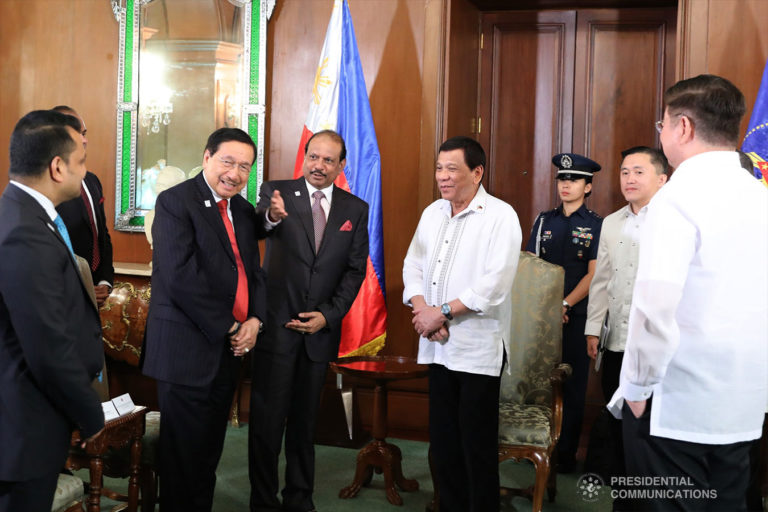

Covering the week’s most noteworthy business news impacting the Filipino-American and Global Filipino community.

NO, merely renting out your house, condo, or apartment does not attract IRS audits. But yes, there are rental items that attract IRS scrutiny: • Deducting expenses that are disproportionately…

FOR those who are eyeing to buy a Maserati or Alfa Romeo in Southern California, look no further than Maserati Alfa Romeo of Puente Hills. Maserati Alfa Romeo of Puente…

1. BLENDED Federal Income Tax Rate: For Corporations tax elected to use a fiscal year will pay a blended tax rate and not the 21% flat rate. The new rate…

More than 200 buyers and over 220 sellers are set to participate in this year’s Philippine Travel Exchange (PHITEX) – organized by the Tourism Promotions Board (TPB), the marketing arm…

BEING audited by the IRS is dreaded by most taxpayers. My clients constantly asked which method increase their chances of getting audited. Let’s compare two methods of filing your tax…

THE clients are seniors who just stopped working two months ago. The husband is 75 and the wife is 71. They own a house with $140,000 in equity. Their unmarried…

THE California Fair Pay Act (a.k.a. the Equal Pay Act), enacted in October 2015, prohibits employers from paying employees less than those of the opposite sex for “substantially similar work,”…

I KNOW we’ve never met. But there’s a common fear that everyone shares when they’re in debt. As a bankruptcy attorney, I hear it from people who consult with me…

Hundreds of foreclosures resulted from Wells Fargo glitch Democratic lawmakers in Sacramento are hoping to overturn a court ruling that would order California to use $331 million in helping homeowners hit…

• PERSONAL exemptions: the personal exemptions for you, your spouse, and dependents are suspended. This line item may not even show on your 2018 Form 1040. • Credits for child…

Q: I WORK as a nurse at a hospital that has a strict policy of no unapproved overtime, and no going on breaks unless we are relieved by another nurse….

YES, definitely. Mistakes can get you audited by the IRS. Let’s discuss common mistakes that can get you into trouble. 1. Filing On Paper Paper-filed error rate is 21% compared…

ARE you struggling every month to pay your debts, especially your credit card bills? Are you always worried about not having enough left over for your mortgage, rent, food and…

I REPRESENTED a foreign company with a $250,000-claim for a 40-foot container of manufactured goods that it delivered to the debtor, a California company, on December 30, 2014. The debtor…

THE San Manuel Band of Mission Indians officially began its major expansion project, marked by Yaamava’, a celebratory event and groundbreaking ceremony, that was observed by dozens of community leaders,…

Fil-Am sugar artist Albert Daniel partners with Fountain Valley Regional Hospital and Medical Center to gift cake pops as parting gifts to maternity ward patients GIVING birth is life’s greatest…

(Part 4) IN part 1: we defined 1) who are resident aliens, nonresident aliens or both, 2) who are exempt individuals, and 3) closer connection exception. In part 2: we…

THE bustling SouthBay Pavilion Mall in Carson became the apex of the Filipino-American community last August 4 and 5 during the Travel, Trade and Consumer Roadshow (TTC). The event is…

Equal rights in parental leave benefits Q: I HAVE been working 4 years for a large company in Los Angeles. My wife just gave birth to our first child. When…

THE first senior is 73. He has been separated from his wife for 30 years but not divorced. So, for all intents and purposes, he is single because even if…

THE Internal Revenue Service currently audits less than 1% of tax returns annually, so your probability of attracting IRS audit is incredibly low. Taking deductions that are higher than average deductions…

Do you have old debts in the past that you haven’t paid and are wondering if the creditors can still come back now and collect from you after so many…

YOU have not filed your income tax returns for the current year and previous years because: 1) you decided you are not required to file? 2) You are a victim…

Hypermarket operator LuLu Group International is planning to invest $1 million in the Philippines for its export venture of products such as fruits and vegetables, textiles, garments, furniture, and electronics….

IRS scores tax returns for audit. The higher the score, the more likelihood that you’ll be chosen for audit. 1. Scoring system: The IRS uses a Discriminant Function System (DIF)…

THE client is a foreign company that has been doing business with a California company since 2012. The client is one of the world’s largest manufacturers of a certain kind…

DOUGLASs Troester worked as a shift supervisor of coffee giant, Starbucks Corporation. As shift supervisor, he performed store closing tasks where he transmitted daily sales, profit and loss, and store…

WHEN people are going through financial difficulty and are unable to pay their bills, their first reaction is often to ignore their debts and avoid contact with creditors. They think…

Free event on Aug. 4 & 5 features exhibitors, seminars, entertainment & food AN exciting summer weekend of Pinoy pride is coming up on August 4 and 5 at the South…

YOU may exclude from gross income gain from sale of principal residence under Internal Revenue Code Section 121. 1. You may be able to exclude gain of $250,000 or $500,000…