How to lose money in the stock market

(Part 1 of 4) LISTEN to friends and neighbors: Your friend had just hit the big time with a red-hot stock tip. This is big money. Mucho dinero. You follow…

Covering the week’s most noteworthy business news impacting the Filipino-American and Global Filipino community.

(Part 1 of 4) LISTEN to friends and neighbors: Your friend had just hit the big time with a red-hot stock tip. This is big money. Mucho dinero. You follow…

THE client is 65. She still works middle management and earns $37,000 yearly. Although she is married, I would say that she has some kind of money agreement with her…

WITH credit card debt approaching $1 trillion according to the Federal Reserve, there is no doubt that thousands and thousands of families who can’t pay their credit card debts are…

LUNAR New Year is upon us, so the Asian Journal is proud to announce that it is partnering up with CCYP Media Network for the exciting 2019 Asian American Expo…

1. TAX identity theft is a significant threat. Fraudsters are more sophisticated and large breaches happening so frequently like the 2017 Equifax incident which affected many Americans, so beware if…

LET’S learn some tips from the greatest investor of all time – Warren Buffet, the Oracle of Omaha. 1. Be greedy when others are fearful and fearful when others are…

HOW can you answer a question like this? Let’s comment about debt. The Bible says that one should neither be a lender or a borrower. It does not seem to…

A GROUP of Assistant Branch Managers, who worked for JPMorgan Chase in California, sued the bank in a class action claiming they were misclassified as exempt employees. Because of the…

ARE you sick and tired of being in debt and having bad credit? Do you want to start over but simply don’t know where to begin? Is filing bankruptcy an…

U.S.-based burger chain Smashburger has been fully acquired by Jollibee Foods Corp. following the purchase of its remaining stake in the Filipino-owned fast-food chain for $10 million (P526 million). Jollibee…

“While bankruptcy is not for everyone, millions upon millions of people who have no way of getting out of debt have found it to be the BEST thing that they ever…

“A severance pay is usually calculated according to a specific formula, often based on the employee’s length of service. An employee may try to negotiate for more severance pay than…

“ Look at the picture of the Indonesian guy who is the oldest man alive at 145. I mean what can you do at 145? You’re practically a cadaver and…

(THIS is a continuation of Part 1 from last week’s weekend edition of Asian Journal) Multi-billionaire Warren Buffett lives simply and adheres to basic but savvy investment principles. 6. Buy…

Federal Land partners with Nomura Real Estate Development and Isetan Mitsukoshi Holdings Ltd. to build The Seasons Residences and first Mitsukoshi Mall in the country Japan is known to be a…

YOU have not filed your income tax returns for the current year and previous years because: 1) you decided you are not required to file? 2) You are a victim…

I’VE seen a rise in the number of cases with payday loans and they are becoming a common issue in bankruptcy filings. What happens to payday loans in bankruptcy? Payday…

WARREN Buffett became one of the world’s richest people by adhering to simple doctrines. Let’s learn from his simple living and savvy investing. 1. Be frugal • Multi-billionaire Warren Buffet…

LATE last year, bipartisan senators proposed a new law called Ending Forced Arbitration of Sexual Harassment Act of 2017 for Congress’ approval. This bill would ensure that every person facing…

“It looks to me that there’s more stuff going on here, although it’s my policy not to get involved in matters that are between husband and wife. I think wife…

THE proposed General Appropriations Act or the P3.757-trillion budget for 2019 has been passed on its third and final reading by the House of Representatives. The P3.757 trillion budget is…

HOW you will benefit from standard deduction versus itemized deduction. To maximize your deduction, you take the larger of standard deduction or total amount of itemized deductions by bunching itemized…

“Once the trustee and his lawyers start to administer the bankruptcy estate assets, they will make a lot of money.” THE clients are married to each other and they are both seniors….

Pasay City, November 25, 2018—Following its success in China, Kazakhstan, Russia, and Thailand, the Business Innovation Congress opened its first congress in the Philippines at Conrad Manila with the theme:…

IT’S the day before Thanksgiving and I’m here in my office still working on cases. The freeways are crazy today and everyone’s trying to get somewhere to be home with…

NEW technology gadgets were on display at the latest CES (Consumer Electronics Show) in Las Vegas – wall TVs, Virtual Reality and smart phones, but the most fun to watch…

“California law generally requires employers to provide suitable seats to employees when the nature of the work reasonably permits the use of seats. Calfornia courts have clarified that the phrase…

“Once the trustee and his lawyers start to administer the bankruptcy estate assets, they will make a lot of money. I understand that the moneymaking bankruptcies are offset by the money-losing bankruptcies;…

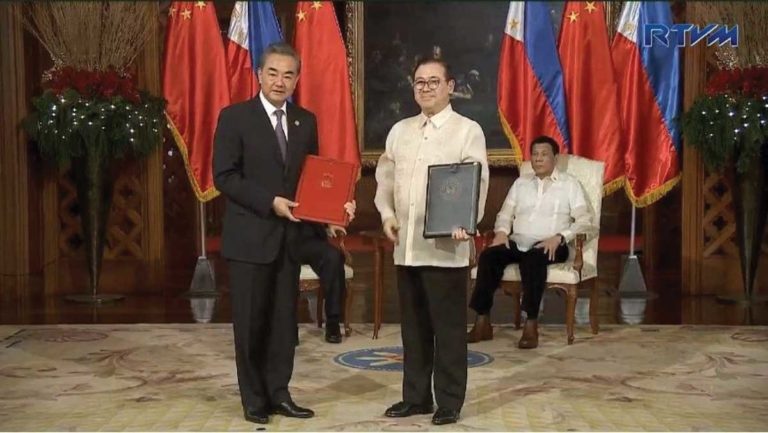

Amid critics calling for transparency, Malacañang has promised it will issue the details concerning the deals signed during Chinese President Xi Jinping’s official two-day visit to the Philippines earlier this…

Philippine President Rodrigo Duterte and Chinese President Xi Jinping on Tuesday, November 20, signed 29 agreements signifying a “milestone in the history of exchange” between the two countries. “Thanks to…