In 2023, the Philippine flag carrier:

- Opened two new routes: Manila – Perth, Cebu – Laoag

- Relaunched 13 routes: Manila – Beijing, Manila – Shanghai, Manila – Xiamen, Manila – Jinjiang, Manila – Macau, Cebu – Seoul, Cebu – Kalibo, Manila -Tuguegarao, Cebu – General Santos, Cebu – Ozamiz, Cebu – Legazpi, Clark – Busuanga, Clark – Caticlan

- Carried out fleet investments including the purchase of nine Airbus A350-1000 long-range jetliners, valued at more than USD 3.2 B (PHP 176.6 B)

- Constructed two brand new Mabuhay Lounges in Manila and Cebu and refurbished other lounges across the Philippines

- Launched a new customer relations management system to provide more personalized passenger services

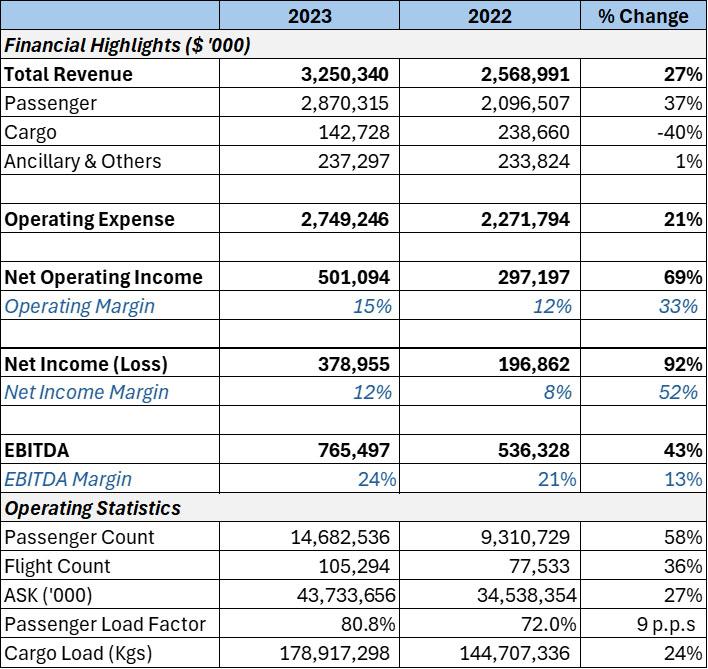

Philippine Airlines (PAL) marked a banner 2023 with its all-time strongest financial performance.

The Philippine flag carrier registered a 2023 net income of USD 379 Million (PHP 21 Billion), a 92% increase from the USD 197 Million (PHP 11 Billion) net income logged in 2022.

PAL achieved this positive performance amid a robust increase in operations and passenger traffic, both internationally and domestically.

The flag carrier operated 105,294 flights in 2023, a 36% growth from the 77,533 flights mounted in 2022, an increase of more than 27,000 flights. The increase in flight activity enabled PAL to carry 14.7 Million passengers in 2023, a 58% uptick from 9.3 Million passengers in 2022.

With the continued recovery of air travel post-pandemic, PAL recorded a 37% surge in passenger revenues from USD 2.1B (PHP 114B) in 2022 to USD 2.9B (PHP 160B) in 2023. Total Net Revenues, including cargo and ancillary revenues, grew by 27% from USD 2.6B (PHP 139B) to US 3.2B (PHP 181B).

Total operating expenses rose by 21% to USD 2.7B (PHP 153B) from USD 2.3B (PHP 123B) in 2022 mainly due to the 36% increase in number of flights operated in the current year. Fuel remains the largest cost of PAL, representing 31% of revenues. Fuel cost increased by 8% year-on-year to USD 1B (PHP 57B) due to the increase in flight activity offset by the decrease in jet fuel prices in 2023 versus 2022.

Operating Income grew by 69% to USD 501M (PHP 28B), from USD297M (PHP 16B) and earnings before interest, taxes, depreciation and amortization (EBITDA) increased by 43% to USD 765M (PHP 43B). Operating and EBITDA margins substantially improved to 15% and 24%, respectively, reflecting the increased scale and efficiency of PAL’s operations.

PAL Holdings President & Chief Operating Officer Lucio C. Tan III thanked the customers who entrusted their travel journeys to PAL and commended the dedication and commitment of the PAL Group workforce. “I express my profound thanks for the support and loyalty of our valued passengers and assure them of our unstinting focus on taking care of them when they fly with us. I laud the strategic approach of the PAL management team in navigating industry challenges. Our greatest resources are our people in the PAL Group who have stood resilient and have adopted a transformation mindset that benefits the company and its customers,” Mr. Tan said.

PAL President and Chief Operating Officer Captain Stanley K. Ng said, “To preserve the gains we have achieved, we must not rest on our laurels. PAL’s corporate transformation continues – we are taking in new aircraft, retrofitting cabins of current aircraft, upgrading airport lounges and introducing more product innovations to address our strategic, financial and operational needs across all areas of our operations. Our focus is set firmly on taking care of our customers. We will work collaboratively with government authorities and our service partners to build up our network and take the nation’s flag carrier to new heights in the coming years.”

The USD 379M net income was the highest in PAL’s history, excluding any one-off restructuring benefits.

PAL plans to capitalize on the increased resources to strengthen its global and local network, upgrade its aircraft fleet and introduce new and improved products and services in the coming years.

Financial and Operational Highlights