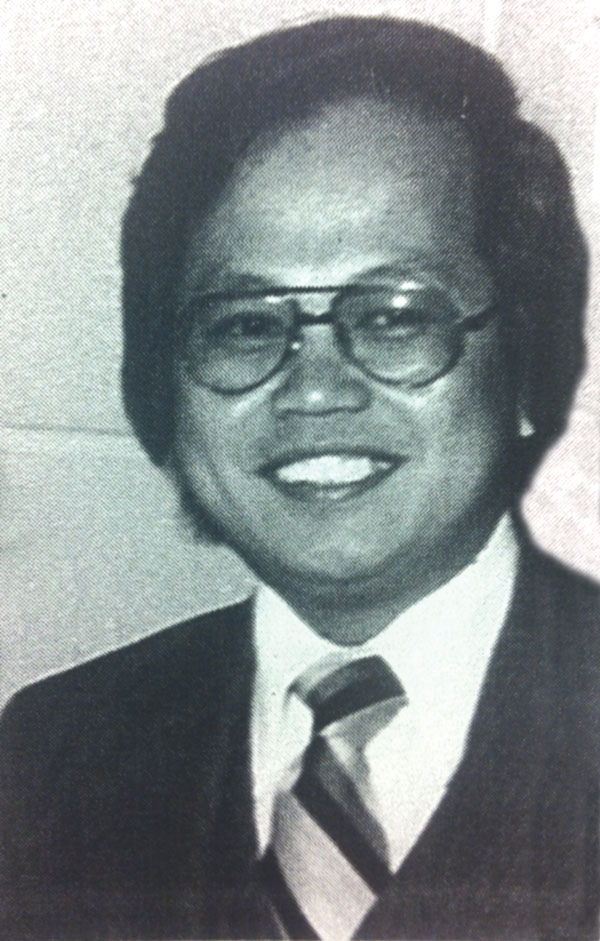

Jun Reodica was sentenced to 10 years for $64 million scam

Eminiano “Jun” Reodica Jr., a native of the Philippines incarcerated for bank fraud, passed away on March 17, 2021 in Texas, sources confirmed with the Asian Journal. He was 76 years old.

Reodica was serving his 10-year sentence in federal prison for a bank fraud scheme that caused more than $64 million in losses to five banks.

By all accounts back in the 1980s, Reodica was a successful Filipino immigrant, living the great American dream as an entrepreneur. He built his auto empire from the ground up and operated what was then the largest minority-owned business in Southern California, employing about 450 people, mostly Asians.

At that time, he was the president of the Grand Wilshire Group of Companies, which operated about two dozen car dealerships, including Grand Chevrolet in Glendora, then the third-largest car dealership in the country. It was quite an impressive feat for a young man who moved from Laguna, Philippines to the United States in the early 1970s and started working as a restaurant busboy.

In less than five years, he became the vice president of a car dealership in Encino and would later start a car financing and loan company, building a foundation for what would become his legacy.

According to the San Gabriel Valley Tribune, Newsweek and the Wall Street Journal touted his business empire as one of the leading car dealers helping minorities buy cars and get car loans.

Many Filipino Americans had invested in his businesses, some emptying retirement accounts or borrowing from banks to invest with a fellow countryman whom they trusted, according to numerous accounts reported in the Tribune between 1988 and 1995.

As a result of Reodica’s fraud scheme, the Grand Wilshire Group and Grand Chevrolet collapsed into bankruptcy in August 1988 amid all these allegations of fraud, which is when Reodica fled to the Philippines.

The court proved that Reodica ran a fraud scheme that caused millions of dollars in losses to the banks (one of which collapsed as a result of the losses suffered in the scam) and his more than 1,000 investors. In addition to being sentenced to 10 years in prison back in 2017, Reodica was ordered to pay $29.7 million restitution.

A Department of Justice ruling said that United States District Judge S. James Otero called Reodica’s scheme to defraud “extremely serious,” stating it caused “much disruption, much heartache” to “too many victims to count.”

Judge Otero said the defendant preyed upon members of the Filipino community, as well as numerous federally insured financial institutions, in perpetrating an extremely serious fraud scheme that resulted in total losses to both individuals and financial institutions of over $90 million.

“In addition to the financial institutions, individual investors, who primarily consisted of members of the Filipino community in Los Angeles, trusted defendant with their money, the vast majority of which was lost following the bankruptcy,” prosecutors said in documents filed with the court. “In total, the investors sustained an additional $24.9 million in losses.”

Reodica, who was dubbed “Brisbane’s Bernie Madoff,” according to government sentencing papers, was a fugitive for 24 years living a new life in Australia.

He was arrested on Nov. 28, 2012 at Los Angeles International Airport during a layover while traveling from Australia to Canada en route to attend his stepdaughter’s wedding, as previously reported by the Asian Journal. A mandatory fingerprint check revealed that he was the fugitive the FBI had been searching for after more than two decades. When special agents with the FBI arrested him, Reodica was traveling under an Australian passport in the name of “Roberto Coscolluela.”

According to FBI reports, while living in Australia under the name of Coscolluela, Reodica ran a tax preparation and insurance business. His activities in these businesses have resulted in allegations of a $7 million fraud in the country, most of his victims were reported to be Filipino-Australians.

Bank fraud

Reodica pleaded guilty to 26 counts of bank fraud and making false statements to financial institutions on the day before he was set to go on trial in October 2015.

From 1984 through 1988, the fraud scheme victimized at least five banks – Union Bank, First Los Angeles Bank, Manilabank, First Central Bank and Imperial Savings.

Specifically, Reodica admitted to promising the same car contract as collateral to two different banks at the same time. This scheme involved directing employees to forge customer signatures on car contracts and then promising the forged contract to a second bank. The fraudulent conduct also involved repossessing and reselling cars without telling the banks.

Reodica also admitted concealing from the banks that customers were delinquent on their car loans.

In some cases, when the overall delinquency rate exceeded a level acceptable to a bank, Reodica used GWG funds to make car payments, which allowed him to continue using those delinquent contracts as collateral. Reodica also made his employees sign for car loans for cars that they were not buying in actuality so that Reodica could increase the lines of credit he obtained from the banks.

“The scale of the fraud is virtually unparalleled,” prosecutors wrote in their sentencing memorandum. “[T]he financial institutions that defendant preyed upon suffered losses in excess of $64.2 million. Notably, Imperial subsequently failed and went into receivership with the FDIC based on the losses sustained as the result of defendant’s fraud.”

“Over time, GWG became the second-largest Chevrolet dealership in the United States and the third largest car dealership in the United States,” prosecutors wrote in court documents. “Due to the apparent success of GWG, [then-California] Governor [George] Deukmejian appointed defendant to the board of the California Department of Motor Vehicles, and later ousted him from the board when his fraud was discovered.”

He is not the only scammer from Laguna Philippines. A second swindler is still alive and what he does is swindle banks with spurious loans and swindle individuals into his flaunted astoundingly profitable smuggling operations (sugar, rice, peking duck, Chinese fruits, etc) His victims include a Filipino wife of a rich Japanese, and his own colonel uncle. He has amassed so much money he is able to bribe his way out of trouble with the law. Even the “great”Juan Ponce Enrile when Enrile was the head of the investigation into the Subic rice smuggling attempt in several year ago, could not pin him down. Senate security officers could not find him and declared he was out of the country when all the time he was lodged in the “B” Hotel in Ayala, Alabang and strolling the malls at leisure.

Who is this guy and his name so people can avoid being scammed by these guy ? Why can’t he get caught?

Jun Reodica did not commit this crime alone yet he did not involve any one. I admire him for protecting those who committed the crime with him. May God’s Love and mercy brings peace and comfort to his survivors and may he rest in peace.