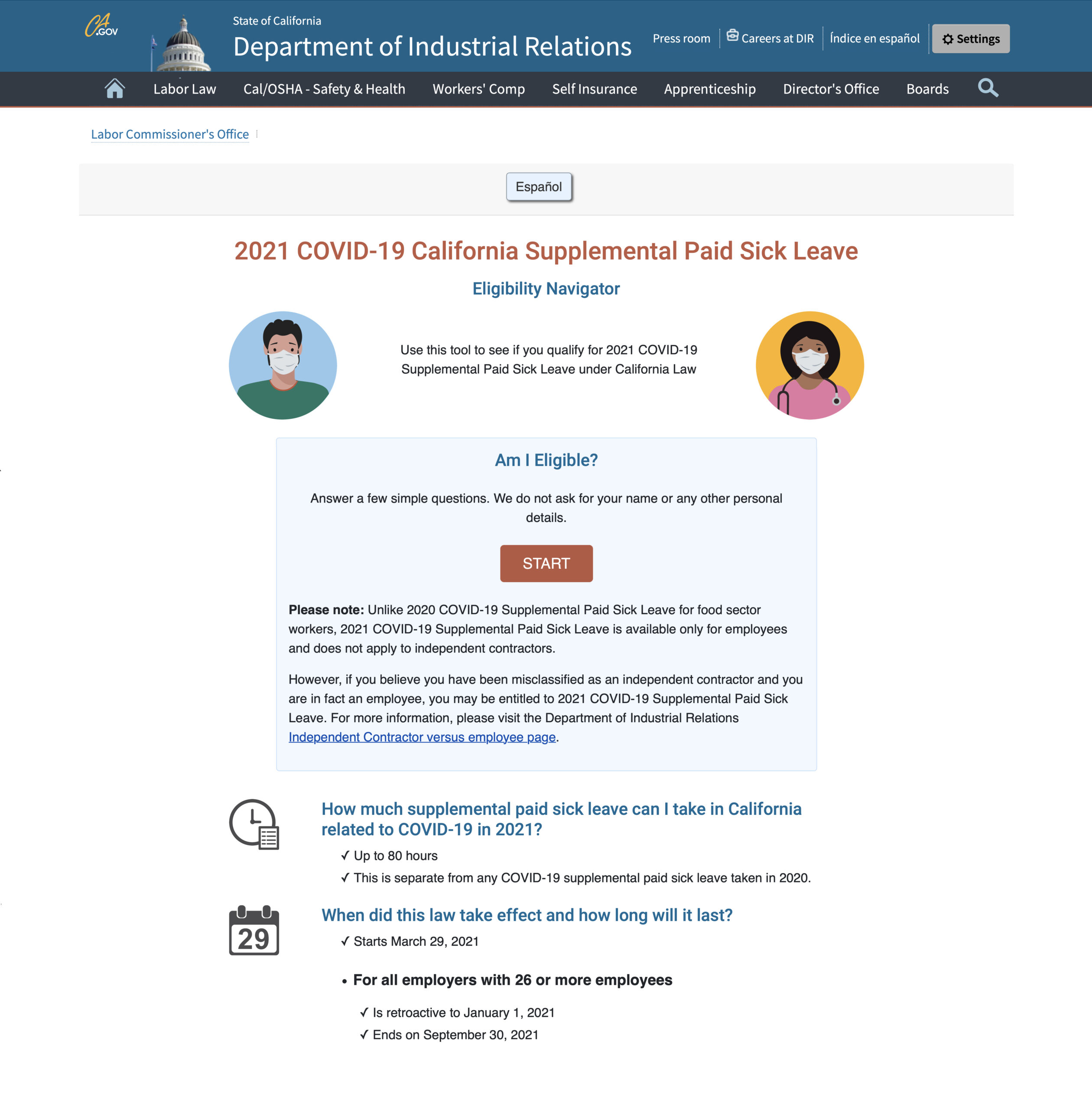

The Department of Industrial Relations (DIR) and its California Labor Commissioner’s Office have launched a web-based tool in English that offers key information on the new 2021 COVID-19 Supplemental Paid Sick Leave law, Senate Bill No. 95, signed by Governor Newsom on March 19.

The Department of Industrial Relations (DIR) and its California Labor Commissioner’s Office have launched a web-based tool in English that offers key information on the new 2021 COVID-19 Supplemental Paid Sick Leave law, Senate Bill No. 95, signed by Governor Newsom on March 19.

“The 2021 Supplemental Paid Sick Leave law provides workers up to 80 hours of paid sick leave if they or a family member are unable to work or telework due to COVID-19, including for vaccine-related reasons,” said Labor Commissioner Lilia García-Brower. ”We designed this tool so workers and their employers can get information on workers’ paid sick leave options.”

The law, which went into effect on March 29 and is retroactive to January 1, 2021, requires that California workers are provided up to two weeks of supplemental paid sick leave if they are affected by COVID-19. Among the key updates in the new legislation, leave time now also applies to attending a COVID-19 vaccine appointment and recovering from symptoms related to the vaccine. The new law is in effect until September 30, 2021. Small businesses employing 25 or fewer workers are exempt from the law but may offer supplemental paid sick leave and receive a federal tax credit, if eligible.

The navigator tool, available in English, helps workers and employers confirm if they are eligible for COVID-19 supplemental paid sick leave by answering short simple questions on the impact COVID-19 is having on an employee’s ability to work. Workers and employers need not provide a name or other personal details to determine eligibility. In addition, Supplemental Paid Sick Leave FAQs are posted online.

In the FAQs, workers can find information on:

- Required circumstances for taking COVID-19 leave

- How to request paid sick leave from your employer

- Where to file a claim if you were not paid for leave

- What rights you have as a covered employee

Employers can find information on:

- When must employers pay COVID-19 sick leave

- Calculating leave time for full-time and part-time employees

Requirements for informing employees about the new law - How to calculate and list paid leave on pay stubs

The law also includes unique provisions for firefighters. The law defines what constitutes an “active” firefighter and it identifies the member firefighter agencies covered under SB 95.

Employees may also be eligible for workers’ compensation benefits if they believe their COVID-19 illness is work-related. In that instance, workers should tell their employers about their work-related illness as soon as possible and file a workers’ compensation claim, which pays for medical treatment and partial wages during recovery. For support, please contact the Division of Workers’ Compensation’s Information and Assistance Unit or call 1-909-383-4341.

Workers whose employers refuse to provide paid sick leave or COVID-19 supplemental paid sick leave as required by law, or prevent workers from accessing paid sick hours, are encouraged to call the Labor Commissioner’s Office at 833-LCO-INFO (833-526-4636) to file a wage claim.

The Department of Industrial Relations’ Division of Labor Standards Enforcement, or the California Labor Commissioner’s Office, combats wage theft and unfair competition by investigating allegations of illegal and unfair business practices. Californians can follow the Labor Commissioner on Facebook and Twitter.