Weight gain/weight loss foods

THE average adult gains one pound (0.45 Kilos) a year. Packing an additional 20 pounds (9 Kilos) a year multiplies the health risks of every one of us. The question…

THE average adult gains one pound (0.45 Kilos) a year. Packing an additional 20 pounds (9 Kilos) a year multiplies the health risks of every one of us. The question…

THE US Court of Appeals for the 9th Circuit last week joined the US Court of Appeals for the 5th Circuit and reversed its previous decision in De Osorio et….

Another feel-good moment is added to the highlight clips of Philippine Sports with the Azkals winning the Philippine Football Peace Cup crown that was held last September 25 to 27….

ARE you being harassed by your creditors day and night due to unpaid bills? If you are, you know that this is a pretty unpleasant experience. You may feel scared,…

YEARS ago, a parishioner was complaining to me that our church was not doing enough work to alleviate the sufferings of the poor in our neighborhood. Being the new pastor…

TODAY, more Filipinos are tightening their belts to sustain themselves not only through the rainy days, but for as long as the prices of commodities continue to rise. Despite the…

A FEDERAL jury in Los Angeles recently awarded a former supervisor of the United Parcel Service, Inc. (UPS) more than $18 million in damages after he was fired for filing…

A client of mine said he never saw it coming. Everything he ever wanted in life, he always purchased on credit. The “pre-approved” credit cards just kept coming in the…

OBVIOUSLY, the easiest way in stopping the IRS from seizing your property or rights to property is by paying the taxes you owe. In today’s economy, however, it is not…

Many people, desiring to save money, try to handle their immigration matters on their own. They may have a relative in the Philippines being processed for an immigrant visa, and…

The abuse of alcohol is the leading risk factor for disability and premature death in the world. Alcohol-related deaths claim almost 80,000 lives each year in the United States alone….

EACH year, I consult with hundreds of individuals who have been ordered to leave the US by Immigration Judges. In the vast majority of these cases, the person had applied…

Once again, they had their chances. Pitted against the competition, they fought it out, and the outcome was somehow satisfactory. With the afterglow of its successful golden campaign in the…

IF YOU’VE ever been in a situation in your life where you had to file bankruptcy as a last resort in order to get out of debt, you know exactly…

To take the risk of possible death from surgery that is necessary to save life or to maintain or restore health makes intelligent sense. But to die from an elective…

WE often hear that “politics” exists not only in governments but also in corporations, schools, civic organizations, and even in churches. We find this contention to be true when we…

Q: I HEARD that the Supreme Court recently decided a case about the employer’s obligation to provide lunch breaks. Some say the employers won the case. But others say the…

JUST one month into the Obama Administration’s Deferred Action for Childhood Arrivals Program (DACA) more than 75,000 applications for deferred action and work authorization have been submitted to the USCIS….

WHEN Canada’s Prime Minister Stephen Harper made his appointments to the Senate in Canada, no one was more surprised than Filipino Canadian Tobias Enverga Jr. Enverga, a long-time bank executive,…

On February 19, 2012 and May 26, 2012, respectively, two males of Filipino descent committed driving under the influence of alcohol (DUI) as first offenders in Glendale, California. The Mercedez…

IF YOU are like a lot of people who have old, unpaid debts, collection accounts and judgments from their past that they don’t even remember, you may feel that it…

Each month, the Visa Office of the State Department publishes, in the Visa Bulletin, the priority dates for that particular month, for the various family and employment based categories. A…

Yes, billion microorganisms! That’s not a typo. That’s how many unwanted and potentially dangerous bugs there are on average in almost any kitchen. So, it is not the bathroom that…

It is very common for beneficiaries of family based petition to wait many years before their petition’s priority date becomes current. This is usually the case with US Citizen parent…

THE mark of a great athlete is his ability to transcend generations of spectators. In the past, the glory of being an athlete was immortalized in poetry and the other…

A FEW days ago, I was telling my parishioners in a homily about a Catholic priest who was traveling by train through Siberia. Sitting next to him in the train…

QUESTION: I want to petition an orphan. What must I do? Answer: A USC can petition for an orphan under age 16. In order to be an orphan, both parents…

OBVIOUSLY, the simplest way to refinance without extending the term is to select a new mortgage with a shorter term. How do you refinance your 30 year loan after paying…

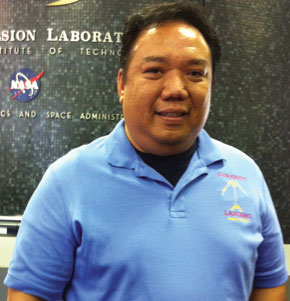

Lloyd Manglapus’ work is literally out of this world. The 42-year-old Manglapus is one of two Pinoys part of NASA’s historic and newest Mars rover called “Curiosity,” as it roams…