Reporting requirements for US citizens abroad

U.S. citizens are generally taxed on their worldwide income regardless of where the income is earned or received. A U.S. citizen who earns income in a foreign country may also…

U.S. citizens are generally taxed on their worldwide income regardless of where the income is earned or received. A U.S. citizen who earns income in a foreign country may also…

Innovation in the 21st century could be summed up into one word: startup. The ubiquity of the Internet, social media and smartphones into our daily lives has established the new…

Malacañang on Monday, October 1, reminded government officials to never seek for special treatment. This is after ACTS OFW party-list Rep. Aniceto “John” Bertiz III received flak for allegedly disobeying…

Philippine Foreign Secretary Alan Peter Cayetano defended President Rodrigo Duterte’s controversial war on drugs at the United Nations (UN) General Assembly held Saturday, September 29, in New York, saying that…

IN today’s column, we will address U nonimmigrant status, commonly known as the “U visa.” This temporary immigration status may be available to a domestic violence victim who is not…

EARLY this month, state and local law enforcement arrested employers who were operating adult residential and child care facilities in the Bay Area. The employers were charged with human trafficking…

LET’S assume that you have incurred too much debt. What do I mean by too much debt? By this I mean that you are now a slave to creditors because…

WE have all heard the popular saying, “Timing is everything.” Unfortunately, this saying often adversely applies to those persons who have found an avenue from which to obtain a green…

INTERNET and social media has become a way of life these days. Almost everyone these day have Facebook, Instagram, Tweeter, etc. as part of their daily lives. These media are…

ON World Youth Day in 2014, Pope Francis challenged young people with this message: “Do you really want to be happy? In an age when we are constantly being tempted…

NO one ever likes to talk about bankruptcy. However, it’s simply a fact of life. Things happen. Whether it’s losing your job, going through a divorce, having huge medical bills…

THE IRS will tell you what records to bring to an audit. The requested documents varies based on your situation. They will need support for income that you report and…

For years, the United Nations awards people from around the globe with the title “champion of the earth.” The said title is considered the institution’s highest environmental honor as it…

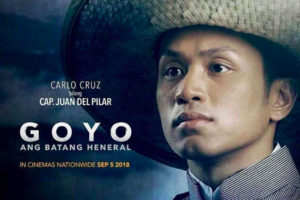

New York based actor Carlo Cruz was still based in Manila late 2012 when he auditioned for Heneral Luna. He didn’t get a call back. He moved to New York…

WASHINGTON, D.C. – The Philippine Overseas Labor Office in Washington DC (POLO-WDC), through the leadership of Labor Attaché Angela Librado-Trinidad, organized a town hall meeting and fellowship event for Filipino nationals…

SACRAMENTO – AB 2514, authored by Assemblymember Tony Thurmond (D-Richmond), supports the creation and expansion of dual language immersion programs in schools. The bill passed out of both legislative houses…

MAJORITY of Filipinos want the current administration to immediately address rising prices of basic goods and services. The figures from the September 2018 Ulat ng Bayan revealed that 63 percent…

FILIPINO-American footballer Kaycee Clark was proclaimed the winner of the 20th season of reality TV show “Big Brother.” Winning via a 5-4 vote, Clark closely beat out fellow finalist/houseguest Tyler…

“Every judge needs to have both the intellectual capacity to deal with the incredible variety and complexity of the issues and an instinctive understanding of the human implications of the…

SUMMONED by invitation from the cultural office of the Philippine Consulate, out of ink-the news world trooped to the Community Hall to witness the launching of PNP Global Community Relations…

The Court of Tax Appeals dismissed the motion of Jaime Napoles, husband of priority development assistance fund (PDAF) scam alleged mastermind Janet Lim Napoles, to quash the lawsuit against him…

Philippine Historical Association Secretary Jonathan Balsamo said on Monday night, September 24, that in order to address the impending historical revisionism among younger generation, the existing learning materials about the…

In order to regulate the number of visitors in Boracay Island, tourists going to the island after its reopening may soon be required to wear access bracelets, according to the…

Latest data showed that 19 out of 154 children who died after receiving at least one dose of Dengvaxia, had dengue despite the vaccination as reported by the Department of…

BRETT Kavanaugh, President Donald Trump’s nominee to be the Justice of the Supreme Court thought he would get the affirmative votes to be confirmed by the Senate Judiciary Committee on…

There is a possibility that more former mutineers from the Magdalo group, who were granted amnesty by the previous administration, might have their amnesty like Sen. Antonio Trillanes IV revoked….

Cal State LA student Janiella Cuala plans to develop a mentoring program in Guam for students interested in a STEM career When she was growing up in Guam, Janielle Cuala’s…