EARL Valencia has been working on startups for as long as he can remember and he has made it his passion to help accelerate the development of the startup ecosystem in the Philippines.

Over the past decade, he was able to build three startup accelerators focusing on the Philippines – IdeaSpace for emerging market needs (70+ startups), QBO, the national innovation center of the Philippines (300 startups) and Cognity Labs, AI accelerator (3 startups).

These initiatives were instrumental in the country as it paved the way to have the Philippines’ startup and innovation law that was passed in Congress.

Because of this string of achievements and in recognition of the programs that helped the Philippines’ startup ecosystem, Valencia was honored as one of the Ten Outstanding Young Men (TOYM) of the country in 2016.

This year, Valencia is spearheading yet another project, this time focusing on finance technology and digital financial services.

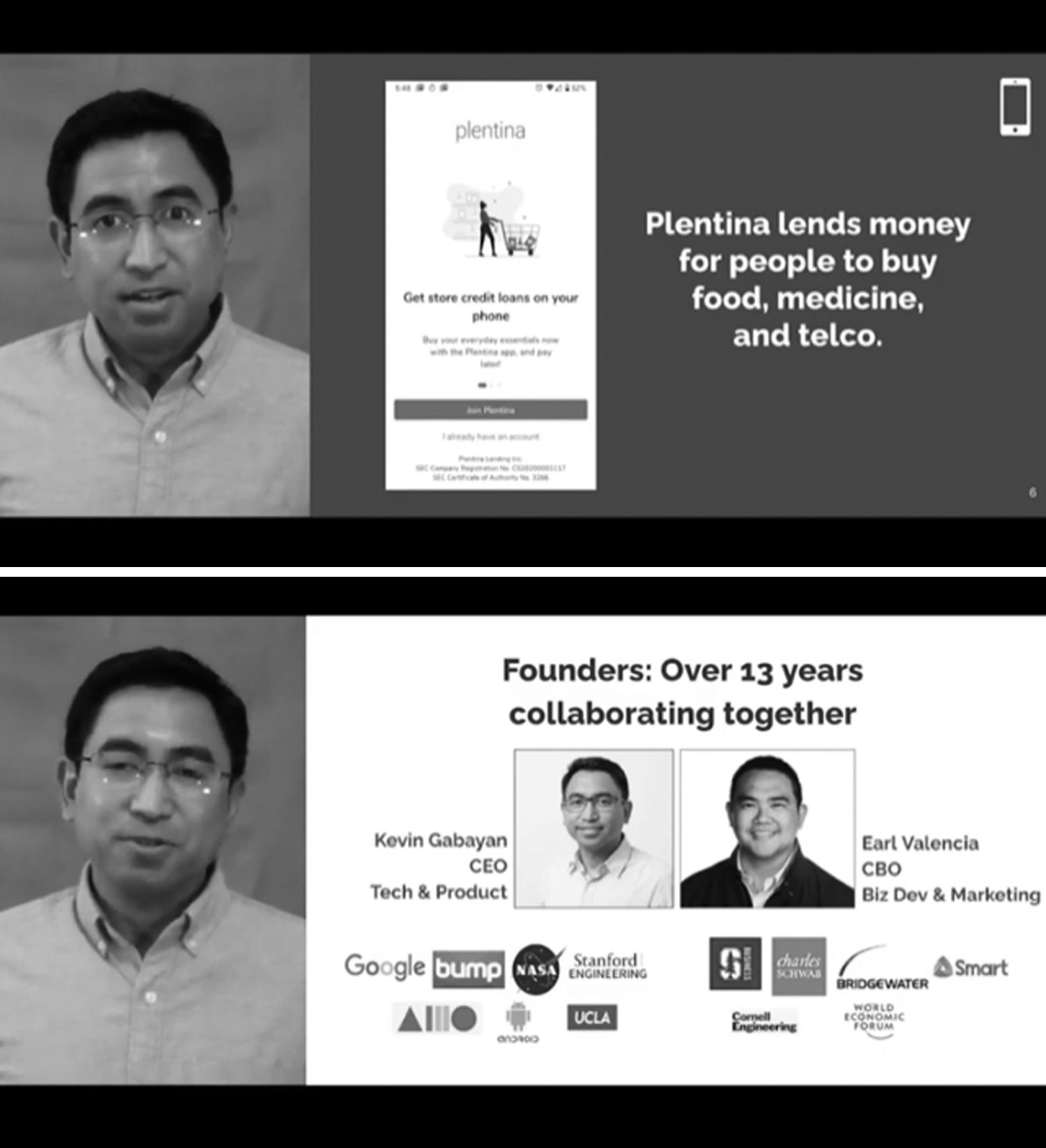

Earl and Kevin Gabayan, his partner in this venture were friends in Stanford, Kevin was in the PhD program for Machine Learning and Earl was taking his MBA at the Graduate School of Business.

They were both members of Filipino Graduate School Club, and were even co-presidents of that club at that time. Gabayan was previously a computer vision researcher at NASA Ames, and led data science at Bump Technologies when it was acquired by Google.

Valencia on the other hand was an aerospace engineer by training before going to business school. He founded a startup incubator while he was VP of the largest telecom in the Philippines, held executive roles at Bridgewater and Charles Schwab, and was a World Economic Forum Young Global Leader.

The duo started in late 2019 with the concept of Plentina, which they hope would create better financial opportunities to the emerging markets in the Philippines.

They had a test launch recently with 7-11, one of their partners in the Philippines. They are also looking to scale their operations and build more financial products for the digital generation of the country.

Valencia shared that the name Plentina is from the song “Table of Plenty” that Kevin heard in Church. The song says that everyone can benefit because there food is plentiful to share.

“We attached ‘na’ because that gave it a unique spin, but ‘na’ is also a uniquely Filipino expression, so you can say, it’s like ‘plenty na,’” he quipped.

He hopes that through the power of technology, more and more people in the Philippines will be able to establish a good line of credit and gain access to better financial tools and services.

“We believe that everyone deserves access to credit and the right customer experience for financial services, and with our technology, we hope that we can build an alternative credit score for millions of Filipinos, especially the emerging middle class,” Valencia explained. “We hope that we create more opportunities for Filipinos and people in emerging markets because we help build a new digital first financial services experience for them.”

Accelerator program

Valencia has gone full circle.

When he built Idea Space years ago, he took inspiration from the leading accelerator programs, and one such program is Techstars, a global platform for investment and innovation.

Plentina made it to the 2020 Class of the Techstars and Western Union Accelerator, something that made the founders beyond inspired and excited, specially since it is the first Filipino-led startup to participate in the program.

You see, when applying to these top startup accelerators, all one can do is to pray and hope but not expect to get in. That’s exactly what they did.

“I believe Techstars only takes 1-2% of all applicants, so when we got the call that we are in, Kevin and I did a ‘virtual high five,’” Valencia shared. “The biggest thing really is that we are so excited to be around a group of people, the 10 other startup companies and the team that believe in our vision of financial access and inclusion.”

The companies in the 2020 class are led by diverse founders from around the world including the Philippines, Egypt, Gambia, Hong Kong, Indonesia, India, Israel, Nigeria, Singapore, Spain, South Africa and the United States.

It is already a given that building a startup is extremely difficult and one needs all the help and support possible.

Valencia and Gabayan believe that Techstars will help provide them part of their initial funding ($120k), the network and the mentorship in order to give them a shot to succeed.

The Plentina co-founders have both committed to their investors that after Covid is done, at least one of them will be in the Philippines at least three weeks per month.

They have also hired a country manager, Alex Capulong, who came from the fintech industry in the Philippines to help build out their Philippine operations.

“I think with Covid, we have proven that we can execute virtually and build a business even if our families are based in the Bay Area, NYC/Connecticut and Manila,” he said.

Based on his experience in startups and innovations, Valencia named the must-haves that these new companies should possess in order to thrive and prosper.

“One thing I learned in Techstars that their criteria after we got in are: ‘team, team, team, market, traction, idea.’ I thought it was a typo, but it wasn’t. I think it is important for the founding team to be aligned in the mission of the company and what positive impact you want to see if you become successful,” he shared.

For example, both Kevin and Earl are passionate to democratize financial services in emerging markets, especially the Philippines.

Another area is a balance in the skill set.

“Kevin is one of the smartest Filipino engineers I know, coming from Google’s Android and emerging market credit team. I balance the team with my background in partnerships and investing that I learned when I was VP at Smart Communications and in financial firms Bridgewater and Charles Schwab,” he explained.

The last one is to create something the people want.

“It may seem simple, but if you begin on how you can change the customer experience because of a new technology, a lot of amazing innovations can happen,” he said.

Emerging market

The Philippines has always been called an emerging market and it is something that startups need to take advantage of, in terms of both helping it grow and the business climate it offers.

Valencia said that most investors don’t know that the Philippines is the 13th largest country in the world by population but the amazing thing is that it is one of the youngest populations at age 24 and one of the most digital/mobile savvy.

“I think that you can see the next 10 years of the Philippines to approach the economic sweet spot, where there will be the rise of the middle class,” he shared. “Also, the Philippines is an English speaking country with amazing talent, we feel that we can build a great team from the Philippines even if we start expanding our company beyond the Philippines.”

The startups in (and for) the Philippines have been growing at a steady rate.

There have been many innovations in the Philippines with great funding stories in the social space, including fintech, edtech and others over the past few years, he said, citing coins.ph selling to Go-Jek a few years ago.

“I think that if compared with our neighbors like Indonesia or Singapore, we maybe 3-4 years behind, but I believe that the next 3-5 years [post-Covid of course] will be the golden age for Filipino startups, that we will be set-up to build the next ‘unicorn’ or billion dollar business because of the startup environment,” Valencia said.

He is likewise hopeful that with partnerships between large conglomerates and the government, the passing of the Startup Law and support for incubators like QBO and the DOST Technology Business Incubator (TBIs) in universities, they will be able to find these new companies that will be the next big companies of the country.

As he moves forward to a new chapter in his professional career, Valencia is all set to pack up his suit as a corporate innovator/investor and put on his hoodie as a VC-backed startup founder.