The country’s economy may be rebounding but a lot of people are still feeling the effects of the last economic downturn. Many who have not been able to recover from the last recession are having difficulty paying their debts. Creditors have referred these defaulting debtors to collection agencies. Some of these collection agencies have become too aggressive in collecting these overdue debts such that these collection agencies have engaged in illegal tactics to collect these debts. The more common illegal tactics employed by these shady collection agencies are as follows:

• Collection agencies are supposed to call on reasonable hours or between 8 am and 9 pm. However some of them have been calling in the wee hours or late at night just so that they could get your attention.

• Collection agencies may contact your lawyer regarding the debt if they know that you are represented by an attorney. They cannot contact any other person regarding your debt. Thus, they cannot call your employer, neighbors or leave messages about your debt to anyone.

• Collection agencies cannot make threats. It is therefore unlawful for them to threaten you with bodily harm, arrest, or threatening to let your neighbors or employers know that you have a debt. Collection agencies cannot threaten you with illegal action such as taking money out of your social security check; taking other exempt property or threatening you with jail time.

• Collection agencies must identify themselves and inform you who they work for. But a common tactic is that these collection agencies would pose as a government employee, police, lawyer for the purpose of intimidating you. It is unlawful for collection agencies to pretend to be someone else.

• Collection agencies cannot harass you. Continuous calls at home and work as well as name calling, in-person visits and the accusation that the debtor is a thief are the common forms of harassment. Harassment of a person who owes money is unlawful.

If you do not want to be contacted by the collection agency, you may ask the collection agency in writing to stop further communication with you. Once you have communicated with them your desire not to be contacted anymore, they can no longer call you regarding your debt except to advise you that it is stopping its efforts to collect OR to advise you that it intends to take action, such as filing a lawsuit against you. If you have difficulty paying your debts, you may want to talk to an attorney to discuss your options.

***

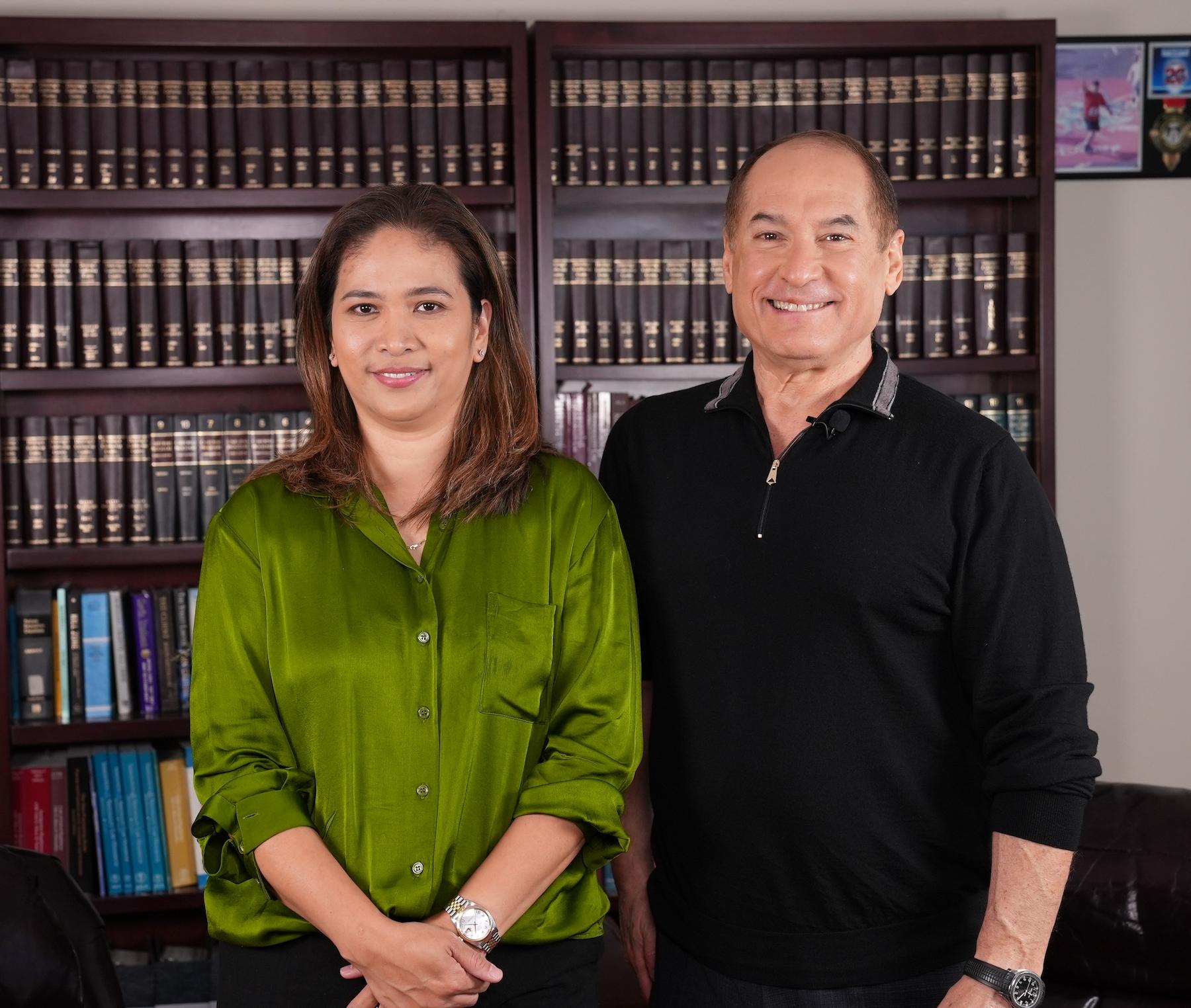

Atty. Dennis E. Chua is a partner in The Law Firm of Chua Tinsay and Vega (CTV), a full service law firm with offices in San Francisco, San Diego and Manila. The information presented in this article is for general information only and is not, nor intended to be, formal legal advice nor the formation of an attorney-client relationship. Call or e-mail CTV for an in-person or phone consultation to discuss your particular situation and/or how their services may be retained at (415) 495-8088; (619) 955-6277; Dchua@ctvattys.com. The CTV Attorneys will be at Max’s Restaurant in Vallejo on October 19, 2009 from 5pm to 7pm to hold a FREE legal clinic.