You just finalized your divorce. You are free and single again. Ever wonder what happens to the will or revocable trust you executed during your marriage with your ex spouse naming your ex spouse or her family as beneficiary in case you pass away?

Well, those documents are revoked by operation of law.

A judgment of dissolution or nullity automatically cancels, by operation of law, non probate transfers between the former spouses or domestic partners. It also terminates the right of survivorship interest in joint tenancies between the former spouses/domestic partners and in community property with right of survivorship. Prob.C. §§ 5601, 5602, 5604. Unless the respective wills otherwise provide, the judgment also revokes all testamentary transfers between the former spouses or domestic partners and any provision in the will of either nominating the former spouse or domestic partner as executor, trustee, conservator or guardian. Probate Code § 6122; Estate of Coleman (2005) 129 CA4th 380, 389, 28 CR3d 282, 288; Estate of Jones (2004) 122 CA4th 326, 332–333, 18 CR3d 637, 641.

A divorce judgment and nullity judgment also affects non probate transfers such as trusts. A broad range of surviving spouse/domestic partner rights are canceled upon finality of a judgment of dissolution or nullity including beneficiary rights under retirement plans, pay on death accounts, transfer on death vehicle registrations, trusts and a marital property agreement. Probate Code § 5600(e) .

Now since Wills and Trusts executed during the marriage is revoked upon entry of divorce or nullity judgment, you should think about setting up a new estate plan after the divorce or nullity to have a new plan in place in case you pass away. If you pass away with at least $150,000 in gross assets and you do not have a living trust (even if you have a will), your beneficiaries would have to open up a probate case before title to the assets can pass to them. When I say gross asset, I mean regardless of how much debt you owe on them. For example if you own a house valued at $850,000 at the time of your death, it does not matter that your mortgage balance is 800,000, a probate case has to be opened in order to pass title to that property. The same is true with other types of assets such as owning a business, a professional practice, bonds, equities, etc. This is a very low threshold to exceed specially in California where real estate prices, even after the economic crisis, remains in the upper end of the curve among the 50 states.

Commencing a probate case is expensive and a very slow process. Someone qualified will have to file a Petition with the probate court to have someone appointed as executor or administrator. The Petitioner’s attorney gets paid a statutory rate for attorney’s fees commencing with 4% of the gross estate. The probate referee will have to be paid for appraising the assets of the estate. If it is necessary to post bond, the premium on the bond would have to be paid as well. There is also the cost of administering the estate such as selling some of the assets to satisfy the estate’s obligations and to divide the estate according to the will or the intestate line of succession if there is no will. The entire process could take up years specially if certain beneficiaries and creditors file certain claims. The probate court file would be public record.

On the other hand if you have a revocable trust, your estate can avoid the entire court system and court supervision. In certain situations, the process may also save you estate taxes which may be substantial if your assets exceed a certain threshold. Basically, you and/or your spouse can be named as the initial trustee of the trust while you are alive. The trustee is the person who manages the trust. This means you retain control of all your assets the same way as if you never had a trust. For revocable trusts, you can later on, at any time during your lifetime, revoke the entire trust if you change your mind.

The assets held in your living trust will be managed by the trustee and distributed according to your directions without court supervision and involvement when you pass away. This can save your heirs time and money. Since the trust would not be under the direct management of the probate court, your assets and their value and your beneficiaries’ identities would not become a public record. Your heirs and beneficiaries would still have to be notified about the living trust and advised, among other things, of their right to obtain a copy of the trust. If you recently got divorced or had a marriage annulled, you should have a new estate plan (wills and trust) set up to save on estate taxes, save on probate and administration cost, and make it more convenient for your beneficiaries to inherit from your estate.

***

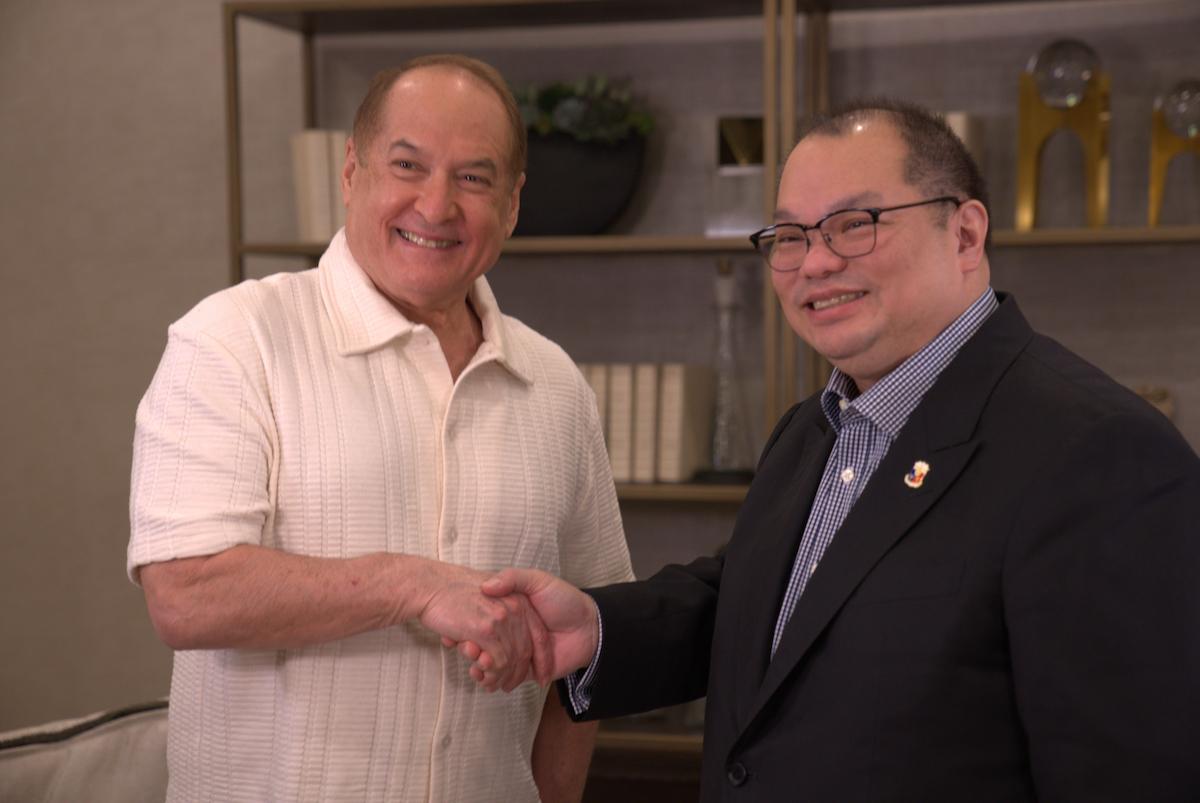

Attorney Kenneth Ursua Reyes is a Certified Family Law Specialist. He was President of the Philippine American Bar Association. He is a member of both the Family law section and Immigration law section of the Los Angeles County Bar Association. He is a graduate of Southwestern University Law School in Los Angeles and California State University, San Bernardino School of Business Administration. He has extensive CPA experience prior to law practice. LAW OFFICES OF KENNETH REYES, P.C. is located at 3699 Wilshire Blvd., Suite 700, Los Angeles, CA, 90010. Tel. (213) 388-1611 or e-mail [email protected]. Visit our website at kenreyeslaw.com