YOU, yes, you. You and all the ordinary hardworking Americans will finally get the much-needed help to defeat COVID-19, save more lives and rebuild our nation — after a year of death, destruction and desperation brought by the coronavirus pandemic.

Yes, YOU, and not just the millionaires and billionaires and corporations of America, have so much to look forward to in order to rebuild your livelihood that was disrupted by the pandemic. Despair no more.

This will be made possible by the $1.9 Trillion coronavirus relief that “allocates money for vaccines, schools, small businesses and anti-poverty programs such as an expanded child tax credit that would mean new monthly payments to many parents,” the National Public Radio (NPR) reported.

Following the process of passing legislation, the American Rescue Plan that the House of Representatives passed was sent to the Senate. The Senate, in turn, had to make some changes, which the NPR explained, are needed to satisfy Senate budget rules and to gain bipartisan support.

This process required negotiations and compromise. No one party could get all that they wanted. This paved the way to the vote on the budget resolution which, the NPR reported, “set in motion a decades-old budget rule called reconciliation to get around the 60-vote threshold to end a filibuster and pass the legislation with a simple majority.”

The Democrat-led Senate was able to pass the bill because they have the numbers for a simple majority to do so even without Republican support to move the bill back to the House of Representatives.

The Republicans refuse to support the bill which they contend is too broad, and does not just fund COVID-related urgent needs. The Democrats, on the other hand, counter-argue that “the bill takes a holistic look at the entire American economy and how it was affected by the pandemic.”

“The major pieces of the bill — payments to individuals, extended unemployment, money for states and localities, money for schools — all of those things were in the COVID package that passed last year that all the Republicans voted for. So they were OK then, but they’re not OK now, and I frankly can’t really figure out that argument,” Maine’s Independent Senator Angus King pointed out.

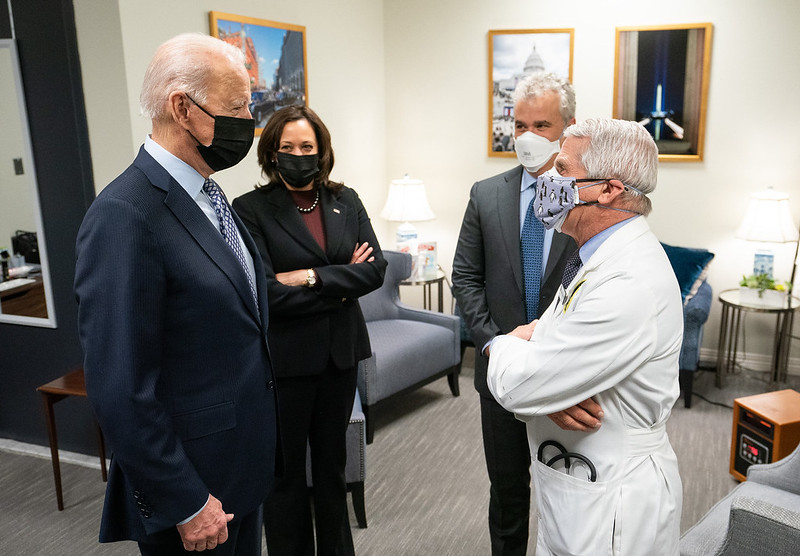

President Biden’s legislative agenda aims to help the American people and the nation “build back better,” a campaign promise he aims to fulfill with the support of Congress.

Time is of the essence, especially for Americans who depend on the help coming from the enhanced unemployment benefits to pay for the basic needs of their families.

Congressional leaders urgently push to get the bill to President Biden before March 14 — the date when current enhanced unemployment benefits are set to expire.

ALL of us need to do our share to tell our representatives in Congress how important it is for them to do their job and pass this bill so it gets to President Biden’s desk for his signature to make this legislation final and executory.

As reported by NPR, the American Rescue Plan will provide:

Direct payments

The bill allocates funds for a third economic impact payment to qualifying Americans.

Individuals earning up to $75,000 and couples earning up to $150,000 would receive the full direct payments of $1,400 per person. Individuals will also receive an additional $1,400 payment for each dependent claimed on their tax returns.

Senate Democrats agreed to lower the income cutoff at which payments phase out from $100,000 to $80,000 for individuals, and from $200,000 to $160,000 for couples filing jointly, following demands from moderate Democrats.

Unemployment benefits

Under the Senate version, federal unemployment insurance payments will remain at $300 per week — down from $400 per week in the earlier package passed by the House. The benefits will extend through Sept. 6. The Senate’s bill makes the first $10,200 in unemployment payments nontaxable for households with incomes under $150,000.

Child tax credit

The legislation would temporarily expand the child tax credit, increasing the amount to $3,000 for children ages 6 to 17 and $3,600 for children under age 6.

The amount is gradually reduced for couples earning over $150,000 and individuals earning over $75,000 per year. Families eligible for the full credit would get payments of up to $300 per child per month from July through the end of the year.

Congressional Democrats and the White House may want to figure out how to make the credit permanent.

Paycheck Protection Program

The bill includes $7.25 billion in new money for the small-business loan program known as PPP and would allow more nonprofits to apply, including those groups that engage in advocacy and some limited lobbying. It also allows larger nonprofits to be eligible.

Education

There are over $128 billion in grants to state educational agencies, with 90% allocated to local educational agencies, plus $39 billion in grants to higher education institutions.

Nearly $15 billion in funds are directed to the Child Care & Development Block Grant program to help support child care facilities, particularly in high-need areas.

The Senate version added a provision to make any student loan forgiveness passed between Dec. 31, 2020, and Jan. 1, 2026, tax-free — rather than having the forgiven debt be treated as taxable income.

Support for low-income families

The bill includes $4.5 billion for the Low Income Home Energy Assistance Program, known as LIHEAP, to help families with home heating and cooling costs. One provision would give the agriculture secretary the authority and funding to temporarily boost the value of cash vouchers for the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) up to $35 per month for women and children for a four-month period during the pandemic.

There is $1.4 billion in funding for programs authorized under the Older Americans Act, including support for nutrition programs, community-based support programs and the National

Family Caregiver Support Program.

The bill provides $37 million to the Commodity Supplemental Food Program for low-income seniors.

Public health

The Centers for Disease Control and Prevention is set to receive $7.5 billion to track, administer and distribute COVID-19 vaccines. Another $46 billion would go toward diagnosing and tracing coronavirus infections, and $2 billion would go toward buying and distributing various testing supplies and personal protective equipment.

Industry support

There’s a variety of provisions in the legislation to offer support to different industries. The Small Business Administration would get $25 billion for a new grant program for “restaurants and other food and drinking establishments.” Grants would be up to $10 million per entity and $5 million per physical location, with a maximum of 20 locations. The legislation sets aside $5 billion of the total money to be targeted to businesses with less than $500,000 in revenue in 2019. The bill includes another $1.25 billion for the Small Business Administration’s Shuttered Venue Operators Grant program.

To support the transportation sector, the bill allocates nearly $30 billion for transit costs, including payroll and personal protective equipment; $8 billion for airports; $3 billion for a temporary payroll support program to help support the aerospace manufacturing industry; and $1.5 billion to recall and pay Amtrak employees who were furloughed because of the pandemic and to restore various daily routes. Another $15 billion would also be allocated to support workers in the airline industry.

Rental assistance

There is $25 billion for emergency rental assistance, including $5 billion for emergency housing vouchers for people experiencing homelessness, survivors of domestic violence and victims of human trafficking.

* * *

The opinions, beliefs and viewpoints expressed by the author do not necessarily reflect the opinions, beliefs and viewpoints of the Asian Journal, its management, editorial board and staff.

* * *

Gel Santos Relos has been in news, talk, public service and educational broadcasting since 1989 with ABS-CBN and is now serving the Filipino audience using different platforms, including digital broadcasting, and print, and is working on a new public service program for the community. You may contact her through email at gelrelos@icloud.com, or send her a message via Facebook at Facebook.com/Gel.Santos.Relos.