Visa applicants may soon be required to submit social media details

“Applicants for diplomatic or official visas will be exempt from the proposed revised questions.” ON March 30, 2018, the Department of State published in the Federal Register its…

Covering the week’s most noteworthy business news impacting the Filipino-American and Global Filipino community.

“Applicants for diplomatic or official visas will be exempt from the proposed revised questions.” ON March 30, 2018, the Department of State published in the Federal Register its…

Offers optimized footprint design, advanced product features, and competitive specifications Easy to install, use, and service quickly Addresses customer needs in a wide-range of industries and environments Elevates industry standards…

THE client is a corporation that has been in business since 2000. It had good times and bad over the last two decades but always managed to land on its…

STARTING March 27, 2017, new applications for offer in compromise (OIC) plus the application fee will be returned by the IRS if all required income tax returns are not filed…

Inaugural hub locations include Historic Filipinotown In Los Angeles, cars continue to be the preferred method of travel for many of the county’s 10 million residents. This is true even…

Manila, 24 April 2018 – Global real estate consulting firm JLL (NYSE: JLL) has acquired JCL International, a Philippine company that provides project management and construction services. Established in 2002,…

CRIMINAL Investigations can be initiated from information obtained from within the IRS when a Revenue Agent (auditor) or Revenue Officer (collection) detects possible fraud. Information is also routinely received from…

THE client is a corporation that has been in business since 2000. It had good times and bad over the last two decades but always managed to land on its…

THESE days, employers generally know that gender discrimination, i.e., singling out someone for negative treatment just because of their sex, is illegal. Employers may have a handbook saying all the…

THE cost of a college education has spiraled out of control for most families. In the last 10 years, student loan debt has sharply risen from $240 billion to $1…

LG Electronics continues to establish its strong foothold in the OLED TV market with impressive, industry-topping sales in 2017. Global sales and shipments prove that LG is, once again, the…

The Bank of the Philippine Islands (BPI) will allocate approximately P50 billion from its stock rights offering (SRO) on four strategic opportunities that will help the Bank in its expansion…

Education has also long been cited as a way out of poverty and a path towards new opportunities and a better future. Yet, inequity in education continues to be a…

WHAT you need to do when you received a call or notice from the IRS? Below are some tips that you should be aware of: • Revenue Officer (RO) observes…

New offering delivers unmatched protection for all apps, with flexible consumption models to fit any deployment and management scenario Manila, Philippines, APRIL 13, 2018 – Coinciding with the Australian Cyber…

THE Internal Revenue Service (IRS) Criminal Investigation Division (CID) conducts investigations regarding violations of the Internal Revenue Code, the Bank Secrecy Act, and Money Laundering statutes. What are warning signs…

TWO clients with issues relating to known and unknown persons who used their names and social security information to borrow credit card in their names. The first client is 51…

Q: I work at a hospital and we heard rumors that our computer servers were hacked. As a result, both patient and employee information were stolen. I am very worried…

IF you are delinquent in your debt obligations and are being pursued by bill collectors, you may be wondering what these bill collectors can do to force you to pay….

DID you know that every 35 minutes an older American dies from a traumatic brain and head injuries precipitated by a fall? In fact, each year 2 million American seniors…

THE client is a senior at 67. He is married but has been separated from his wife for some time. He lives with a woman but is not married to…

Q: AFTER 12 weeks of medical leave for a surgery, I suffered new complications and my doctor told me I needed to take more leave time. I told my employer…

* * * Victor Santos Sy graduated Cum Laude from UE with a BBA and from Indiana State University with an MBA. Vic worked with SyCip, Gorres, Velayo (SGV…

IF you are struggling to pay your bills every month due to insufficient income and/or excessive expenses, there is a way to make your debts more manageable so you can…

Located in the foothills of the San Gabriel Valley and east of Pasadena, California sits Sierra Madre, which gives off a small town atmosphere reminiscent of somewhere in the middle…

THE client is 50 years old and divorced. She owns her residence by herself. Ex-husband quitclaimed the house to her in the divorce and she agreed to buy him off…

“Any use use other than as your principal residence is nonqualified use. This includes vacation home, renting it out, vacancy and allowing someone’s living in it.” (Part 1) You may exclude…

BEING in debt can be pretty depressing. I understand how you feel. When you’re drowning in debt, you may feel that your situation is hopeful and you have no motivation…

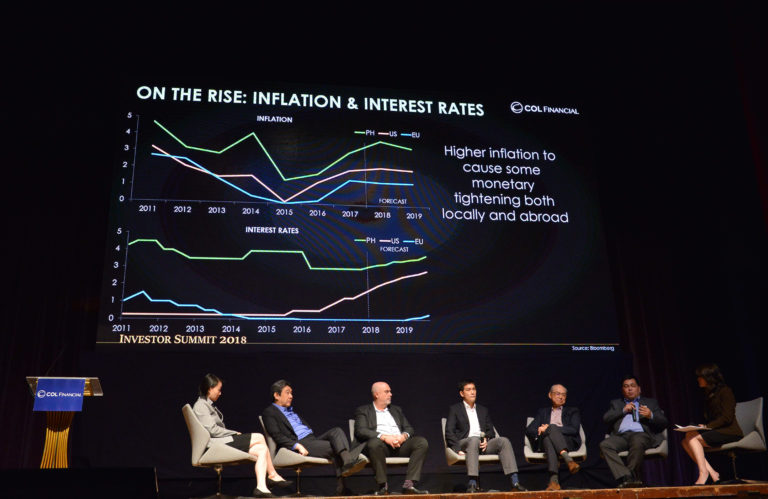

COL Financial kicks off its annual Investor Summit to teach Filipinos how to manage their portfolios better COL Financial recently held its first COL Investor Summit targeting customers actively managing…

The client is 50 years old and divorced. She owns her residence by herself. Ex-husband quitclaimed the house to her in the divorce and she agreed to buy him off…