Last year more than 1.4 million Californians claimed $346 million on their taxes from California’s Earned Income Tax Credit (Cal EITC). CalEITC4Me is the statewide outreach campaign to promote the use of this proven anti-poverty measure. This year, with the program’s expansion to young adults age 18 to 24 and those age 65 and older, more than 2 million people could benefit from the Cal EITC.

However, a major reason more people don’t claim this credit is simply a lack of awareness. People don’t know the Cal EITC is available to them. Many who are eligible to claim the Cal EITC also may not be planning to file an income tax return, which is necessary receive the credit, because their income is low enough that it does not require them to file.

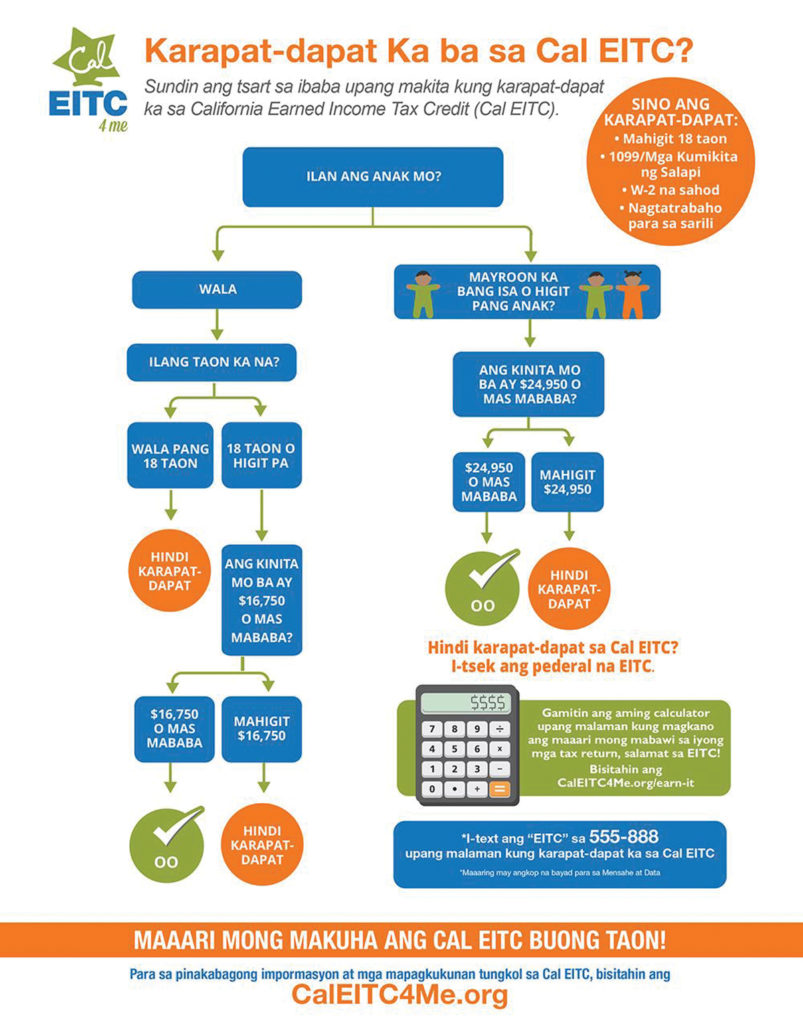

English language proficiency should not create a further barrier to receiving this credit. Last year, CalEITC4Me.org was available in Spanish, Mandarin and Vietnamese and this year it has expanded to Korean, Tagalog and Russian as well.

In addition to the eligibility calculator, there are downloadable flyers in each language with information on other public assistance programs people who qualify for the Cal EITC are likely eligible to receive.

“Our goal is for every hard-working Californian to keep more of what they earn,” said Golden State Opportunity President Josh Fryday, sharing the new resources unveiled this tax season.

Fryday said that it was important to include Tagalog as one of the language offerings given the 1.4 million Filipinos in the state.

“Like so many other Californians, many Filipino-American workers in the Golden State are struggling in this economy,” he said. “That’s why it’s crucial that we offer our services in Tagalog, so language is not a barrier for them in claiming their Cal EITC refund.”

Since its inception in 2015, CalEITC4Me has helped more than 2 million people claim $4 billion in state and federal EITC funds. CalEITC4Me’s goal this year is to ensure that as much as $400 million in Cal EITC dollars reach eligible workers, and that more people file for the federal EITC as well.

The economic impact of this program is profound, pumping hundreds of millions of dollars into the state’s economy through income, business sales, new jobs, and tax revenue.