Question: I have already worked in the United States for some time. Does my sponsor still need to submit the affidavit of support?

Answer: Under INA §212(a)(4)(C), an alien who seeks permanent residence as an immediate relative or as a family preference immigrant is inadmissible as an alien likely to become a public charge, unless the visa petitioner submits an affidavit of support (INS Form I-864) that meets the requirements of §213A. This requirement also applies to employment-based immigrants, if a relative either filed the Form I-140, or has a significant ownership interest in the firm that did file the Form I-140. Section 213A(a)(3)(A), however, provides that the obligations under a Form I-864 terminate once the sponsored alien has worked, or can be credited with, 40 qualifying quarters of coverage, as defined under title II of the Social Security Act. The affidavit of support regulation reflects this provision.

Question: Assuming that I can show that I have worked 40 qualifying quarters, is an affidavit of support still required if, at the time I seek permanent residence through admission or adjustment of status, I am able to show that I have already has worked, or can be credited with, 40 qualifying quarters of coverage?

Answer: The policy of the Service is that an affidavit of support is not required if, at the time you seek permanent residence through admission or adjustment of status, you can show that you have already worked, or can be credited with, 40 qualifying quarters of coverage.

The basis for this policy is that it represents the most reasonable interpretation of this requirement. The obligations under the Form I-864 come into force when the sponsored alien acquires permanent residence. But if, at that time, the sponsored alien already has worked, or can be credited with, 40 qualifying quarters of coverage, then the obligation will expire at the very moment that it begins. Requiring the affidavit of support in this situation, therefore, would serve no purpose.

Question: What if my parent has qualifying quarters of work, but I don’t. Is there anything that can be done?

Answer: INA §213A(a)(3)(B), specifies how an you can be credited with qualifying quarters worked by someone else. If you can claim qualifying quarters worked by a parent, you may claim all the qualifying quarters worked by the parent before the your eighteenth birthday. Note that the statute does not require the parent-child relationship to have existed when the parent works the qualifying quarters. So you can claim even those of the parent’s qualifying quarters that the parent worked before your birth or adoption. You can also claim qualifying quarters worked by a spouse. However, you may only claim those quarters that the spouse worked during the marriage. It must also be the case either you are still married to the person who worked the qualifying quarters, or that that person is dead.

Question: What if I received public assistance?

Answer: You may not claim any qualifying quarter of coverage worked after December 31, 1996, if the person you worked that qualifying quarter – whether it was you, a spouse or a parent, if you have received any Federal means-tested benefit during the same period.

* * *

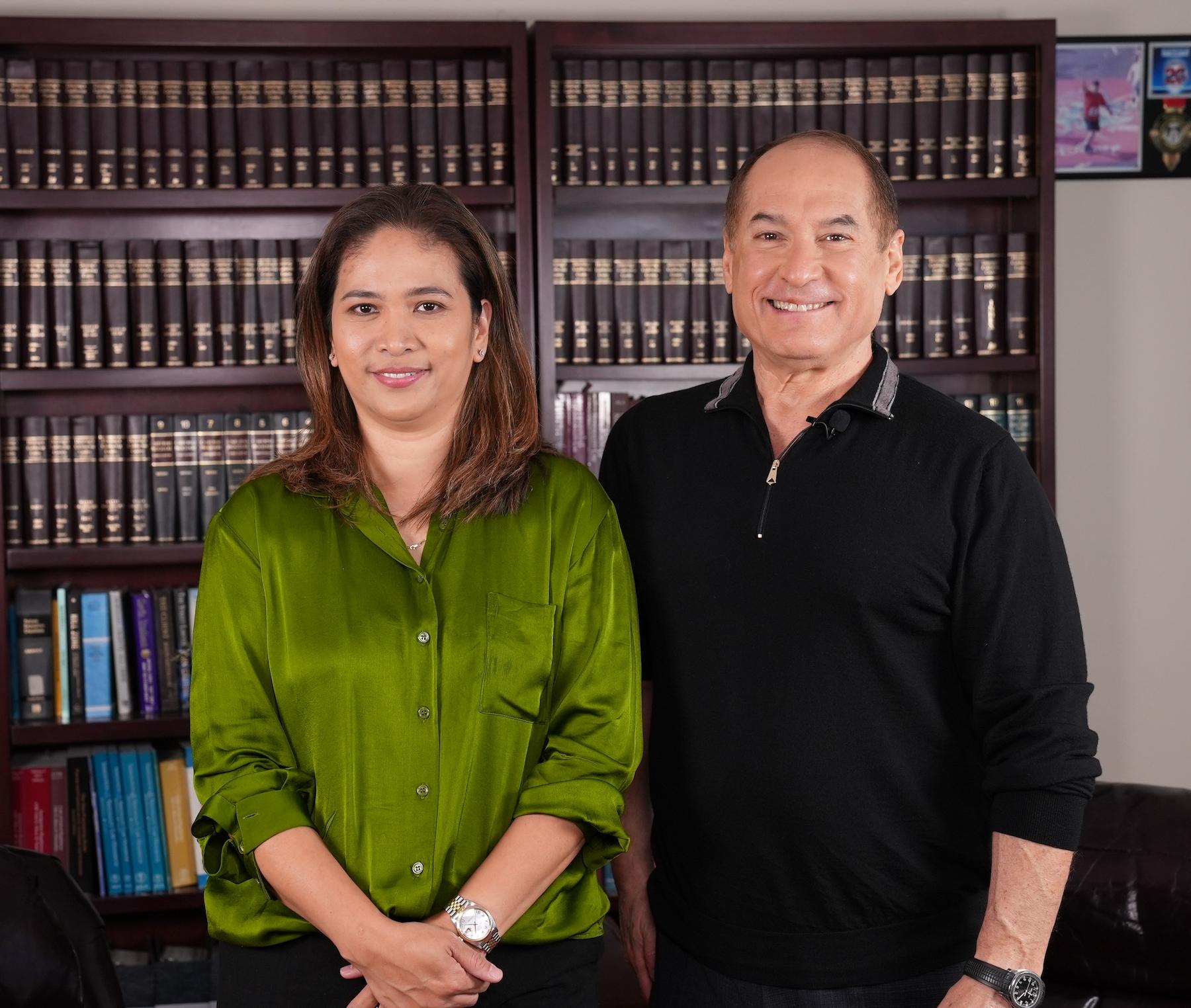

Brian D. Lerner is an Immigration and Naturalization Attorney. He is a Certified Specialist in Immigration and Nationality Law as Certified by the State Bar of California, Board of Legal Specialization. Mr. Lerner is married to a Filipina and has been helping Filipinos immigrate to the United States for nearly 20 years. His firm represents clients in Deportation/Removal proceedings, does Waivers, Appeals, Naturalization, Adjustments, Criminal Relief, Citizenship, Consulate Processing, Work Permits, Investment Visas and all other areas of Immigration and Naturalization Law. You can go online to http://www.californiaimmigration.us/ and get a free consultation or call us at (562) 495-0554 for an in-person office consultation.