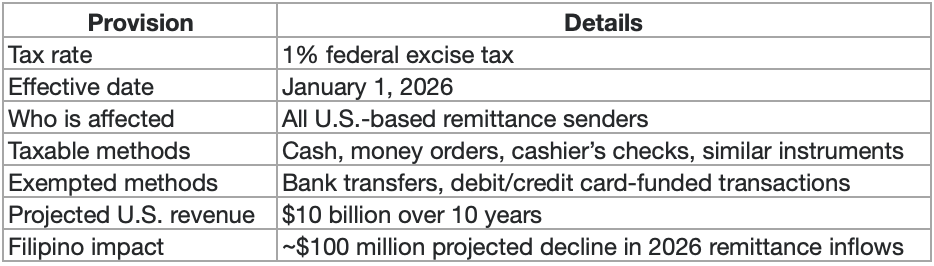

Originally proposed at 3.5% for non-citizens in the House version, the final measure—adopted by the Senate—applies a lower 1% tax to all U.S.-based senders, regardless of immigration status. The Senate passed the bill on July 1 with a 51–50 vote, with Vice President J.D. Vance casting the tie-breaking vote.

According to the U.S. Treasury and budget analysts, the remittance tax is expected to generate up to $10 billion over the next decade, helping fund immigration enforcement, tax relief, and border infrastructure initiatives.

What is covered

The tax applies to remittance transfers made using cash, money orders, cashier’s checks, or similar non-electronic instruments.

Remittances sent through electronic bank transfers or U.S.-issued credit/debit cards are explicitly exempt, according to Senate Finance Committee summaries and final legislative text. The exemption was added to reduce compliance burdens and encourage the use of regulated financial systems.

Impact on Filipinos in the U.S.

Data from the Philippine Department of Finance (DOF) shows that around 20% of the estimated 4.4 million Filipinos living in the United States send money home using non-digital methods. This equates to approximately 880,000 individuals who may be affected by the new levy.

The DOF estimates that the tax could reduce total annual remittances to the Philippines by about $100 million in 2026. While this is a small fraction of the projected $36.5 billion in total inflows, the department noted that any decrease could have a disproportionate effect on low-income households in provinces heavily reliant on remittance income.

Concerns over informal channels

Development economists have warned that the tax, though minimal on paper, may push more migrants to use informal or unregulated transfer channels. This shift could weaken financial transparency, reduce consumer protections, and increase risks of fraud.

The Overseas Development Institute (ODI) reiterated in its June policy bulletin that average global remittance costs remain around 6%, and a federal levy on top of those fees may encourage workarounds.

“A remittance tax of any kind risks reducing household income for families in low- and middle-income countries. It also threatens the transparency of cross-border financial flows,” the ODI stated.

A similar warning came from the Center for Global Development, which noted that the poorest countries—including the Philippines—stand to absorb the steepest relative impact from the U.S. remittance tax.

Financial adjustments ahead

Financial experts have advised remittance senders to review their preferred transfer methods and explore digital options—such as bank-to-bank transfers or regulated apps—to avoid the new tax and benefit from lower fees and added security.

The Philippine government has not issued an official circular on the U.S. remittance tax. However, according to a report published by the Daily Tribune on June 13, 2025, officials confirmed that the government is preparing financial education initiatives for overseas Filipino workers in anticipation of the law’s impact.