Under Trump’s “America First” trade policy, the focus shifted towards protecting U.S. industries, reducing trade deficits, and prioritizing American workers. By renegotiating trade deals and imposing tariffs, the policy aimed to boost domestic manufacturing, strengthen the economy, and challenge global trade imbalances, signaling a more protectionist approach to U.S. commerce.

Officials assess risks and opportunities as Southeast Asia braces for the impact of U.S. tariffs under President Trump’s 2025 trade policy.

MANILA, Philippines — The Philippines is facing rising pressure on its export economy after the United States, under President Donald J. Trump, imposed a 17% tariff on all goods coming from the country.

The move is part of the White House’s newly launched “Liberation Day” initiative, a sweeping trade policy aimed at recalibrating global trade relationships and asserting U.S. economic dominance.

The 17% rate, set to take effect April 9, is part of a broader reciprocal tariff schedule that includes a 10% universal import tariff on most other trading partners, first implemented on April 5.

Philippines Among Least Hit, Says Trade Secretary

Department of Trade and Industry Secretary Cristina A. Roque confirmed that the Philippines is not among the countries most heavily penalized.

“As we have expected, the Philippines is among the least hit among key exporters to the U.S.,” Roque said in a televised interview.

Roque acknowledged that while the 17% rate will impact several key industries, the country is still in a better position compared to others in Southeast Asia.

“We are in a good position to benefit from trade diversion effects,” she added, noting that other countries like Vietnam and Cambodia are facing tariffs of 46% and 49%, respectively.

She also said the government is preparing to engage U.S. trade officials to explore ways to strengthen the Philippines–U.S. trade relationship.

Industries Bracing for Impact

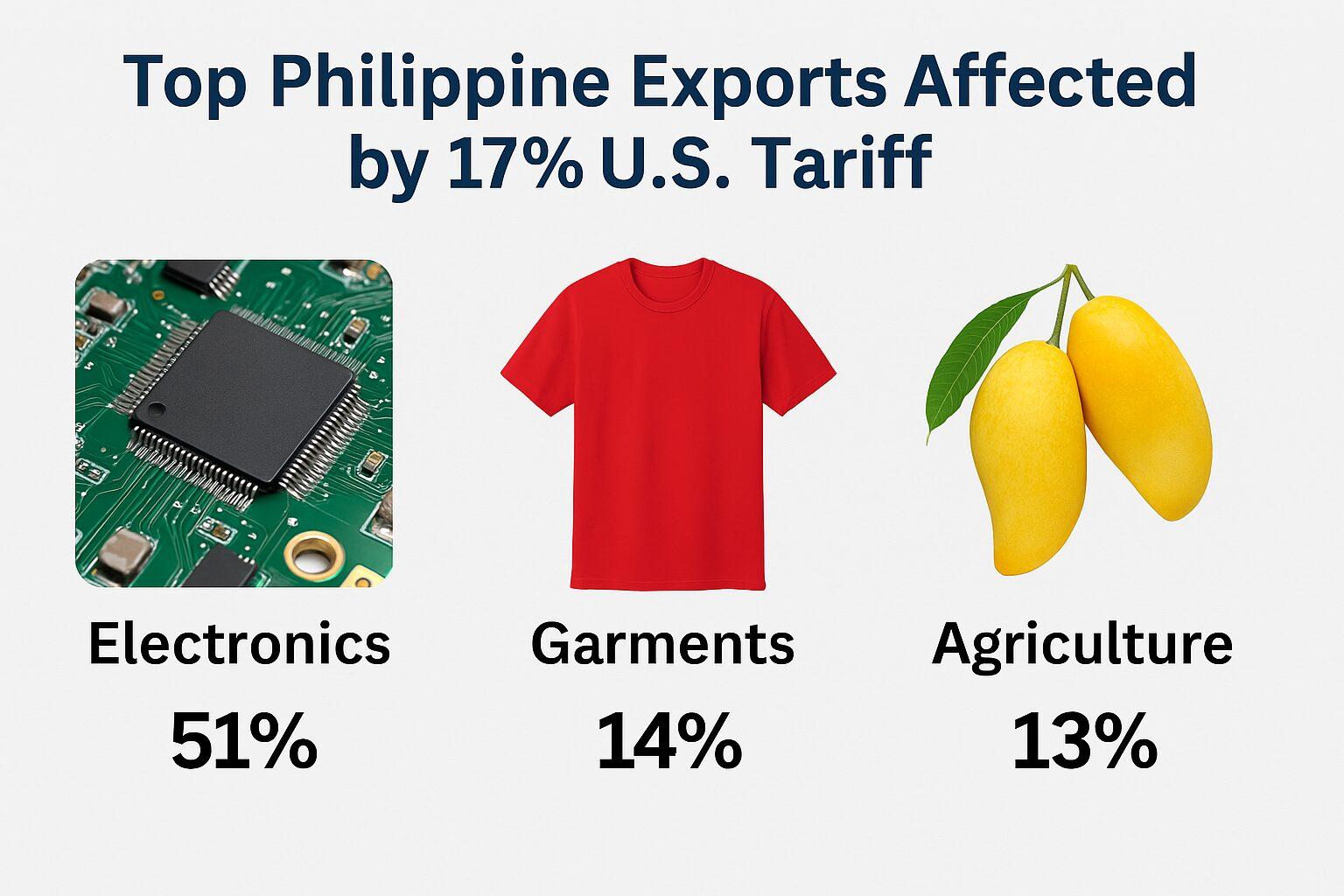

The tariff is expected to hit several core Philippine export sectors:

- Electronics and semiconductors, which account for more than 50% of U.S.-bound exports

- Garments and textiles, which operate on narrow margins and are highly price-sensitive

- Agricultural products, such as coconut oil, processed fruits, and dried mangoes

According to a Bloomberg report, Filipino food and electronics exporters are already considering raising prices to absorb the new cost burden.

Market Reaction Reflects Uncertainty

The Philippine Stock Exchange (PSE) responded to the announcement with two consecutive days of decline:

- April 3: PSEi fell 1.63% to 6,145.73

- April 4: PSEi dropped another 1%, closing at 6,084.19, the lowest since March 4

The iShares MSCI Philippines ETF (EPHE) also posted losses as foreign investors braced for reduced competitiveness of Philippine exports and potential supply chain realignments.

Geopolitical Context: Southeast Asia on Edge

Other Southeast Asian countries have been hit harder by the U.S. reciprocal tariff policy:

- Vietnam: 46%

- Cambodia: 49%

- Indonesia: 32%

- India: 26%

This gives the Philippines a narrow advantage for now—but also raises the stakes for regional competition and long-term repositioning of global manufacturing hubs.

Outlook: Strategic Adjustment Required

While the 17% tariff is a real blow, DTI officials and industry groups believe the Philippines can turn the moment into a chance to diversify trade, improve value-added production, and attract relocating manufacturers fleeing higher-tariff economies.

The DTI has not yet announced any formal economic relief packages, but Secretary Roque said consultations are ongoing with industry leaders and exporters to monitor the situation and support affected sectors.