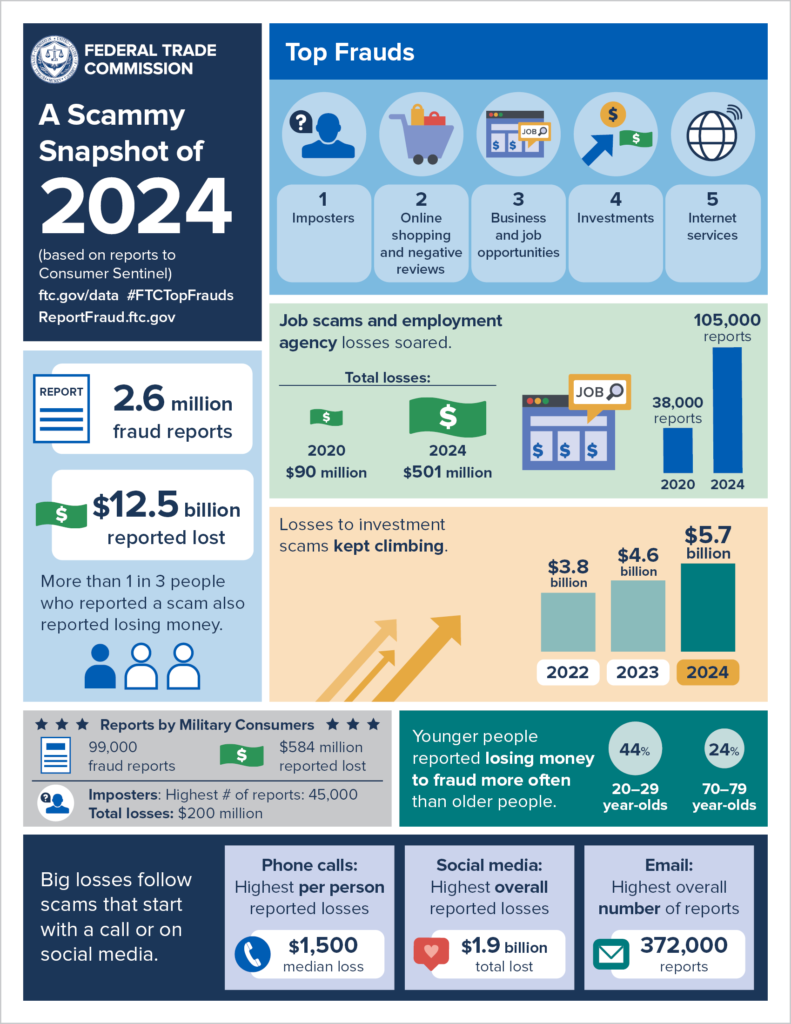

Of the 2.6 million reports of scams submitted to the FTC in 2024, 38% reported losing money, up from 27% in 2023.

US consumers lost $12.5 billion to scammers in 2024, according to new data from the Federal Trade Commission. The figure marks a 25% increase year-on-year, even as the total number of people who reported being scammed remained steady.

FTC officials say the increase demonstrates the continued proliferation of scammers who are evolving their techniques.

“This trend is troubling because we can see that people are losing more money to scammers than in previous years,” says Rosario Mendez, assistant director with the FTC’s Division of Consumer and Business Education. “People are in a lot of places at once, from email to social media to text and in-person. All those things are opportunities for scammers to get you, because they want to go where you are.”

Mendez spoke in an interview with EMS from her office in Washington DC.

Of the 2.6 million reports submitted to the FTC in 2024, 38% reported losing money, up from 27% in 2023.

Imposter scams—where criminals pose as representatives of official agencies—continued to top the list in terms of type of scams out there, with $2.95 billion in reported losses. But investment scams cost consumers $5.7 billion last year, FTC data show, more than any other category. In 2023, that number was $1 billion.

“The difference is staggering,” says Mendez, describing how scammers promise hefty returns on investments in cryptocurrency, for example. “They guarantee your investment will make a lot of money, that it is a unique opportunity.”

She adds, “Of course, the reality is that people lose everything.”

Consumers reported that emails, phone calls and texts remained the most common ways they were reached by scammers, and that more money was lost through bank transfers and cryptocurrency transactions than all other payment methods combined.

Young people ages 20 to 29 lost money more often, though people 70 years and older lost more money overall than any other age group.

“Scammers’ tactics are constantly evolving,” Christopher Mufarrige, director of the FTC’s Bureau of Consumer Protection, said in a statement. “The FTC is monitoring those trends closely and working hard to protect the American people from fraud.”

The Korea Daily recently reported on an intricate imposter scam targeting Korean Americans.

According to the report, a Korean woman in New York received a phone call from someone claiming to be with the South Korean embassy in New York. The caller instructed her to join a video conference, which showed a man dressed as a South Korean police officer in what appeared to be a police office in South Korea.

The woman grew suspicious after the caller demanded her personal information and eventually reported the scam to authorities.

“I have heard of similar stories of scammers claiming to be staff from USCIS or even administrative judges from Immigration enforcement and conducting supposedly an administrative proceeding on WhatsApp,” said Mendez, referring to the federal agency that manages citizenship and naturalization.

“The scam is so elaborate, but people fall for it because it looks so real,” she added.

The FTC released an alert in December warning consumers about this specific scheme, noting it typically starts with a lawyer promising a green card, work permits, or citizenship, often via social media posts in multiple languages. Potential victims hit the like button or leave a comment and are later contacted and solicited for payments via platforms including Western Union or Zelle.

The number one rule of thumb, Mendez says, for avoiding scams is to know that the government or any official agency will “never ask you to pay money to solve a problem… much less through wire transfers, or gift cards, or cryptocurrencies. That’s how you know this is a scam.”

Of the total losses last year, the FTC was able to secure $319 million in refunds to consumers, including $15.5 million for the nearly 43,000 victims of a deceptive job placement scam that targeted service members and their spouses.

The FTC’s latest report draws from the agency’s Consumer Sentinel Network, a database that compiles reports from consumers, as well as an array of local, state and federal agencies, including AARP and the Better Business Bureau. The reports offer an important snapshot of trends and patterns that agencies like the FTC and others can use to better protect consumers and prosecute criminals.

Officials with the FTC stress these reports serve an essential function, allowing law enforcement to pursue cases while giving the FTC the information it needs to keep the public informed. Reports can be submitted anonymously in English and Spanish.

“This is something we can fight through information,” says Mendez, “because we know from experience, and the data bears this out, that when people know about a scam, they are more likely to spot it and avoid it.”