By Cora Mopera, Branch Manager, Chase

Managing your money can be overwhelming but it doesn’t need to be. Understanding things like budgeting, saving, paying your bills, and even building your credit score are skills that can help you at any stage of your life. Even in these difficult times with the pandemic when so many of us are facing greater uncertainty around our finances and job security, it is these types of moments where understanding core financial skills can be the difference maker. It’s important to also pass along this financial knowledge to kids to better equip them for their future and becoming financially independent.

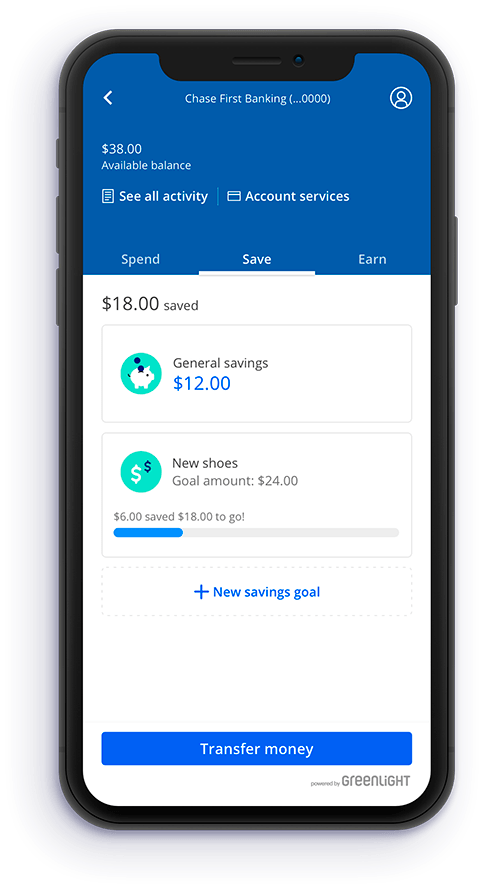

Teaching your kids about money and finances should be done in stages and start as early as pre-school. We grew up learning the concept of a “piggy bank” to save money to buy our favorite toy, but what happens after that? A survey by Junior Achievement USA and AIG shows that only half of the teenagers surveyed say becoming financially independent from their parents is a goal. Introducing resources and tools that are available to your kids, will help lead them to a successful path in taking control of their financial future.

Chase has tools that can help whether the goal is to spend wisely, save, or build credit

Chase’s financial goals hub is a great place to start. Start by picking a goal – save, budget, or build credit – and explore advice, offerings and tools that more simply allow you to control your financial future. Our Grow Your Savings page, for example, offers an interactive calculator that maps out a timeline to reach savings goals and highlights how the Autosave tool can help you manage a regular savings schedule to stay on track and meet your goals. Other resources are also available, such as budget worksheets to monitor and track monthly spending, guidance on using the Credit Journey tool to build and protect credit, as well as background on low-cost checking accounts designed to provide access for anyone who has had trouble getting or keeping an account in the past.

Spending & Budgeting is also an easy-to-use budgeting tool that can help you plan ahead for where your money is going by helping track and manage monthly spending based on transactions within your Chase accounts. You can also create a goal using the Autosave tool that offers an interactive calculator to help you manage a regular savings schedule to stay on track and reach your goal. Another useful tool is Credit Journey which is designed to help build and protect your credit by providing not only your credit score but tips and insights on improving your credit health. Other resources are also available, check out chase.com/student which is designed to help students and parents on their financial journey.

Talking to your kids about healthy financial habits should happen sooner than you think. Teaching them good money habits can build a healthy mindset with their finances. You can guide them along the path to achieving their financial goals and learn from our past mistakes starting at an early age

For more resources, information and access to tools that can help you achieve your financial goals and milestones, visit chase.com/personal/financial-goals.

(Advertising Supplement)