Flag carrier to continue operations, eyes exit from Chapter 11 before year-end

NATIONAL flag carrier Philippine Airlines (PAL) has “voluntarily” filed for restructuring under a Chapter 11 plea in the United States amid the ongoing pandemic that has put a strain on global travel.

PAL President Gilbert Santa Maria said in a video statement that the airline has been working with its creditors, lessors, suppliers, shareholders, and employees on a permanent solution to “complete the recovery and guarantee the future of Philippine Airlines.”

“With this goal in mind, we have voluntarily filed for restructuring under a Chapter 11 process in the United States while simultaneously executing a supporting filing under the Financial Rehabilitation and Insolvency Act in the Philippines,” he said Monday, September 6.

Over the weekend, PAL announced that it has filed for a pre-arranged restructuring under Chapter 11 of the U.S. Bankruptcy Code in the Southern District of New York.

Chapter 11 generally provides for reorganization, usually involving a corporation or partnership, according to the United States Courts. A Chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time.

As explained by PAL chief financial officer Nilo Thaddeus P. Rodriguez during a virtual press conference on Monday (Manila time), Chapter 11 enables the airline to “restructure contracts” that are mostly governed by foreign laws.

“We are thus able to ensure the execution of all such agreements under a well-established legal process that is universally accepted and can be completed expeditiously,” he said.

The proposed recovery plan cuts down the airline’s debt by at least $2 billion. It also secures Debtor-In-Possession (DIP) financing of $505 million, and obtains another $150 million in debt funding from new investors.

“These permanent actions will enable PAL to emerge from Chapter 11 in a few months with fresh capital, lower debt, and a competitive cost structure, giving us a sturdy foundation to sustained profitability,” said Rodriguez.

Reduction of fleet

In addition, PAL announced it will implement a 25% reduction of its fleet by returning 22 aircraft to lessors, leaving the airline with 70 planes, down from 92.

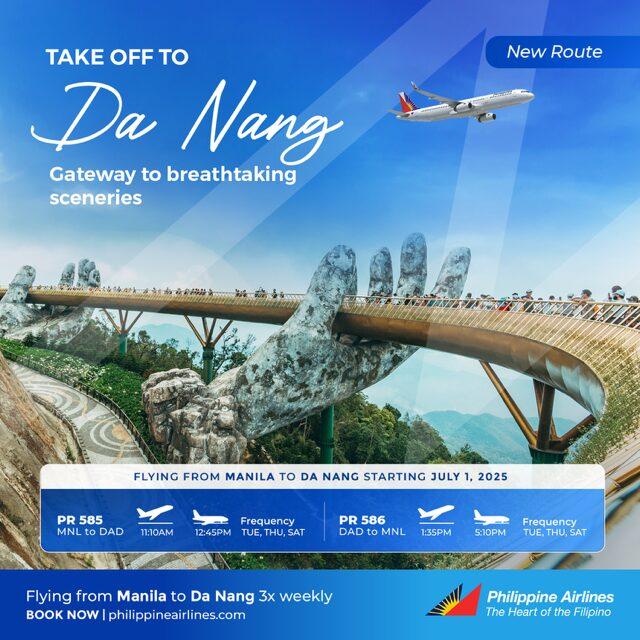

Further, the airline said that it will build back its network by adding services to China and Australia, while boosting flights on key domestic destinations.

“We will complete the recovery of Philippine Airlines,” PAL Chairman and CEO Lucio Tan said in a video message delivered by his grandson and PAL director, Lucio Tan III.

“Together, we will deliver an airline with a reorganized balance sheet, a streamlined workforce, and a renewed sense of mission. It has always been the duty of Philippine Airlines to support jobs and livelihoods throughout our island country and to provide global connections that link the Philippine economy to key markets worldwide,” he added.

Tan also assured stakeholders, passengers, and employees that PAL will “keep flying, now and long into the future.”

However, the airline said that it doesn’t foresee pre-pandemic demand until 2024 or 2025.

“We don’t foresee demand coming back to pre-pandemic levels until 2024, 2025, and at that point in time we don’t believe we will see what our size was, more than $3 billion, in 2025,” said Dexter Lee, PAL’s senior vice president and chief strategy and planning head.

“We expect to see those numbers closer to the back half of the decade,” he added.

In 2020, PAL was forced to cancel more than 80,000 flights as travel volumes were impacted by the COVID-19 pandemic.

Its major lessors and lenders deferred more than $360 million in aircraft lease and loan payments, while the airline’s primary shareholder infused over $130 million in “emergency liquidity.”

PAL also raised over $70 million from the sale of a non-strategic asset, while its employees contributed more than $60 million through voluntary pay cuts and extended leaves-without-pay.

In February, PAL announced the separation of 2,300 employees, including almost half who are leaving voluntarily for a retrenchment completed on March 12.

Santa Maria, however, assured that the fleet reduction will not result in additional job cuts.

“We do not anticipate additional job cuts. The reality of the pandemic is still on us, and that the only caveat to my statement that we will no longer have additional job cuts is we hope the pandemic does not become more serious and we can actually recover,” he said.