“ Let me get one thing straight, just because you can pay your minimum monthly payments each month doesn’t necessarily mean that you do not have a debt problem”

WHILE credit can be a great asset when used wisely, a lot of people tend to misuse it and they acquire more debts than they could possibly pay back. The results can be disastrous because excessive debt can threaten one’s financial future. In this article, let me list some of the warning signs of excessive debt that you should keep an eye on.

FACT: Let me get one thing straight. Just because you can pay your minimum monthly payments each month doesn’t necessarily mean that you do not have a debt problem. This is a common misconception. For example, a lot of people foolishly think that having low monthly payments on their credit cards is to their advantage. Well, this may be true in the short term if you intend to pay off the debt soon. In the long term, however, low monthly payments only benefit the credit card companies. The lure of “low monthly” payments is exactly what ensnares people into debt and with the grossly inflated interest charges accumulating oftentimes for years. It could take decades for people to pay back what they had borrowed. Do you realize how much money you can be losing in giving your money away to the credit card companies?

Never allow yourself to be lulled into a false sense of security that you have your debts under control just because you are never late on your payments and that you are able to manage the monthly minimums. Here are some of the warning signs that you have a credit/debt problem. The more “yes” answers you have to these questions, the more serious you situation might be. In that case, you may need to take more drastic steps to control the problem before it gets out of hand.

You don’t have any savings.

You can only afford to make minimum payments on your credit cards every month.

You use credit cards that you used to pay for with cash, such as groceries.

You are at , near or over your credit limit on your credit cards.

You don’t even know how much you owe anymore.

You take out cash advances on your credit cards to pay other bills.

Your checks are starting to bounce.

You are getting calls from collectors.

After paying your credit card bills, you are completely broke until next payday.

You are always late on debt payments especially your home and car payments.

Sorry for being too blunt and if this offends you. But as a bankruptcy attorney who has dealt with thousands of people with debt problems over the years, I have found that a lot of people tend to ignore the above warning signs until it is too late. Often, people find it easier to fool themselves into believing that their problems do not exist. They are too proud or too blind to admit that they have a debt problem and that they must do something about it. But ignoring the above signs when they are obvious can be likened to having all the symptoms of an illness but refusing to go to the doctor in order to get treatment. In the end, it will kill you if you don’t take corrective action now.

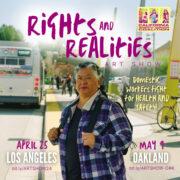

If you are in debt and need to figure out a way to get out, I can help you figure out all your options. Please call TOLL FREE 1-866-477-7772 to schedule an appointment. We have offices in Glendale, Cerritos and Valencia.

* * *

None of the information herein is intended to give legal advice for any specific situation. Atty. Ray Bulaon has successfully helped thousands of clients in getting out of debt. For a free attorney evaluation of your situation, please call Ray Bulaon Law Offices at TOLL FREE 1 (866) 477-7772.